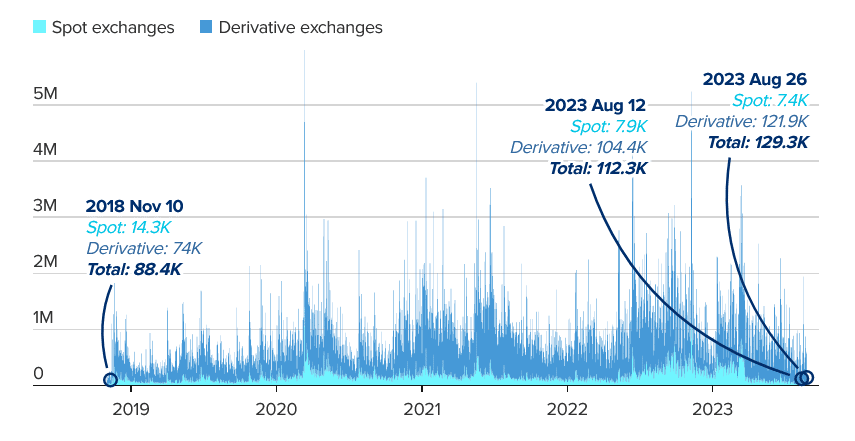

- Based on an examination of CryptoQuant data encompassing both spot and derivatives exchanges, it is evident that the aggregate volume of bitcoin currently held across all trades has reached levels comparable to those observed in 2019.

- According to data provided by CryptoQuant, the trading volume of bitcoin across all exchanges as of August 26 amounted to 129,307 BTC. The current value of Bitcoin has experienced a significant decline of approximately 94% from its peak in March, as reported by the data provider.

- On August 12, the trading volume experienced a decline, reaching a minimum of 112,317 BTC. This level of trading activity has yet to be observed since November 10, 2018.

The trading volume of Bitcoin experienced a notable decline this month, reaching its lowest point in nearly five years. This trend can be attributed to the cautious approach adopted by investors patiently awaiting compelling factors that would motivate their reentry into the market.

An examination of CryptoQuant data encompassing both spot and derivatives exchanges reveals a notable decline in the aggregate volume of bitcoin held across all sales during the initial stages of this month, reaching its lowest point since 2018. Subsequently, the book above has encountered challenges in recuperating.

As of August 26, the recorded bitcoin trading volume across all exchanges amounted to 129,307 BTC, as reported by CryptoQuant. On August 12, the total number of Bitcoin (BTC) experienced a decline, reaching a value of 112,317 BTC.

This marked the lowest level observed since November 10, 2018. The current value of Bitcoin has experienced a significant decline of approximately 94% from its peak in March, which stood at 3.5 million BTC.

BTC trading volumes

November 2018–August 2023

According to Julio Moreno, the head of research at CryptoQuant, it has been observed that trading volumes tend to experience a decline during bear markets, primarily due to the departure of retail investors.

This phenomenon has been noted as a recurring trend. The event above transpired in the year 2022 across a majority of financial exchanges. As the market advances into a bullish phase, there is a possibility of an increase in trading volume.

The current valuation of Bitcoin stands at approximately $26,100, as reported by Coin Metrics, reflecting a year-to-date increase of 57%.

A notable lack of activity within the bitcoin trading community has characterized summer. While seasonal factors may partially explain this phenomenon, it is essential to consider additional contributing factors.

The regulatory measures implemented by the United States government about cryptocurrencies, in conjunction with the resolution of the banking crisis in May, which significantly contributed to its cumulative gains thus far, have resulted in the departure of market makers and traders. Consequently, their re-engagement in the market has yet to be motivated.

Following the substantial decline in bitcoin’s value on August 17, which marked the most significant one-day sell-off since the notable FTX incident in November, the market promptly returned to tranquility. According to the available data, it is evident that long-term investors have displayed resilience in the face of recent market downturns.

In a recent note, analyst Gautam Chhugani from Bernstein remarked that the market exhibited a lackluster performance, characterized by a shortage of new catalysts and limited overall liquidity. This observation pertains specifically to the previous week’s activities in the realm of cryptocurrency trading.

The current state of the market is lacking bullish sentiment, with participants exhibiting a general disinterest in engaging in trading activities. This can be attributed to the market’s anticipation of significant catalysts, particularly in decisions about the various spot bitcoin ETF applications currently under consideration by the Securities and Exchange Commission.

According to Chhugani, the prospect of revitalizing the market rests in adhering steadfastly to the trajectory of the emerging market cycle. This phenomenon typically aligns with the occurrence of the Bitcoin halving event. The forthcoming event is anticipated to occur during the spring season of 2024. Cantor Fitzgerald reiterated the significance of prioritizing long-term objectives.

According to a note provided by Cantor Fitzgerald analyst Josh Siegler on Monday, it is our firm belief that despite the various forms that near-term catalysts may assume, the long-term narrative of sustained cryptocurrency adoption and the enduring viability of bitcoin as an alternative asset and store of value remain intact.

The trading volume of bitcoin experienced a decline on August 12, reaching a value of 112,317 BTC. This figure represents the lowest level observed since November 10, 2018. The preceding iteration of the narrative contained inaccuracies regarding the specific matters of the common and the temporal occurrence of the previous low.