In November 2021, amidst the notable surge in the crypto Market, the combined market capitalization of the four prominent metaverse projects reached its zenith at $16 billion. The present analysis delves into the key factors that have resulted in a significant decline of 98% in the value of metaverse tokens, leading to substantial losses for token holders during the year 2023.

During the Market’s peak in November 2021, prominent terminologies such as Metaverse, GameFi, and Play-to-Earn significantly influenced the cryptocurrency industry. In a relatively short span of approximately two years, many investors who enthusiastically embraced the Metaverse phenomenon faced financial setbacks.

The “Big Four” Metaverse Tokens Have Lost 92% Of Their Value on the Market.

In the context of the 2021 crypto market rally, it can be observed that The Sandbox (SAND), Axie Infinity (AXS), Enjin Coin (ENJ), and Decentraland (MANA) emerged as prominent entities within the Metaverse and GameFi sector. These four projects, in particular, garnered significant attention and exerted notable influence during this period.

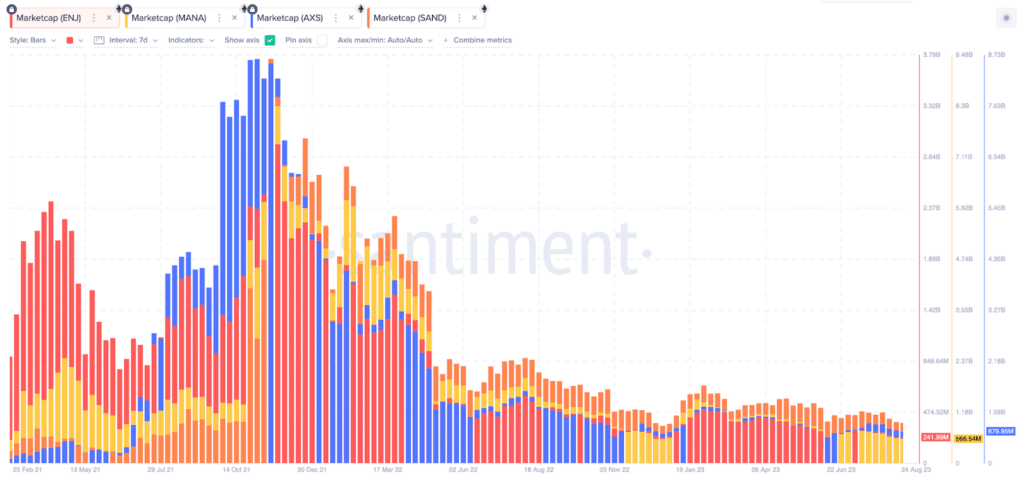

It is worth noting that the collective market capitalization of the four tokens above reached a pinnacle of $16 billion during the peak of November 2021. During that period, the Metaverse tokens constituted a mere 0.5% of the overall market capitalization of the global cryptocurrency market, which amounted to a staggering $3 trillion.

In light of the onset of the crypto winter, Metaverse projects encountered substantial scrutiny encompassing various aspects, including but not limited to security, privacy, community governance, and a perceived deficiency in long-term HODLing incentives.

As of September 2023, the combined valuation of SAND, AXS, ENJ, and MANA stands at a mere $1.23 billion. The observed decline of 92% from the previously recorded market capitalization of $16 billion in November 2021 is noteworthy.

To provide a comprehensive understanding of the situation, it is imperative to acknowledge that the market dominance of the four Metaverse above tokens has diminished to a mere 0.12% of the global cryptocurrency market capitalization.

Metaverse Investors Lose | Market Cap – ENJ, MANA, AXS, SAND | Source: Santiment

Market capitalization is a fundamental financial metric utilized to quantify the aggregate value of a given cryptocurrency’s circulating supply. The statement above elucidates the function of approximating a blockchain’s comprehensive worth at a particular juncture.

By aggregating the market capitalization of the four prominent metaverse projects, stakeholders can understand the sector’s inherent significance in the broader cryptocurrency market.

There has been a notable decline in the level of interest exhibited by cryptocurrency investors towards the metaverse sector within the past two years. There has been a strategic allocation of capital towards sectors that show greater resilience and emerging trends.

The Vast Majority of Investors in the Metaverse Have Suffered Losses

The current state of affairs suggests that individuals who invested in the 2021 metaverse phenomenon face substantial financial setbacks.

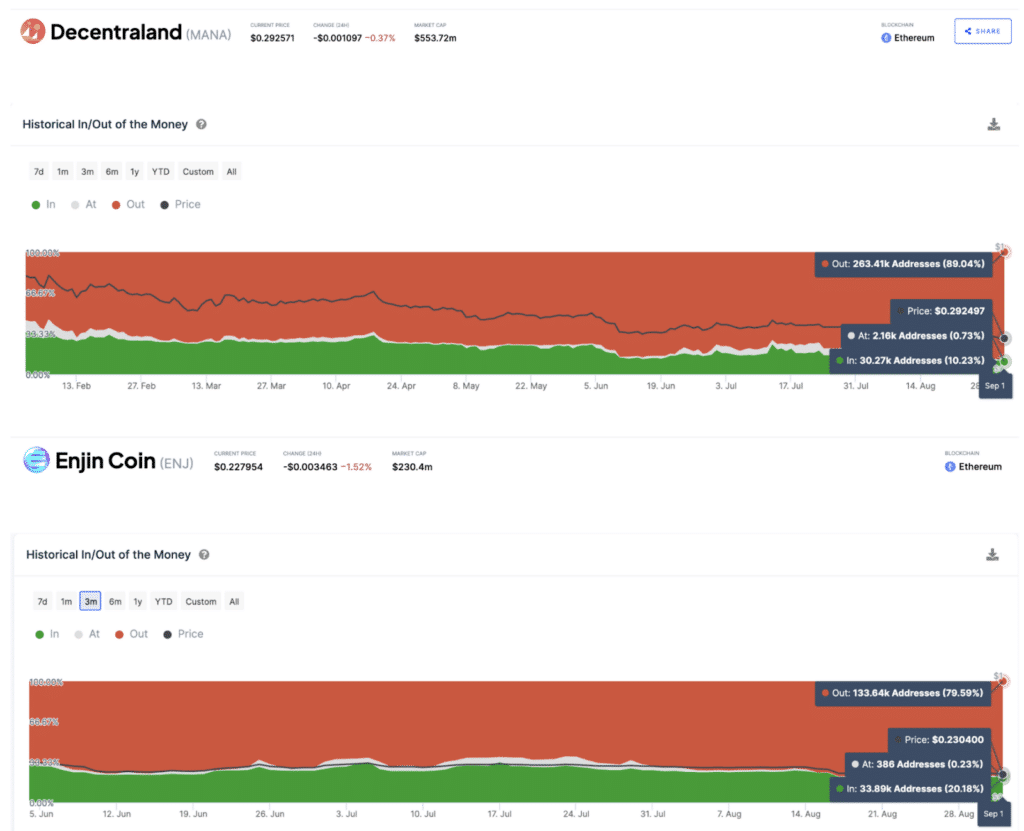

The Historical In/Out of the Money (IOMAP) data provided by IntoTheBlock offers estimations regarding the deficit or profitability levels associated with wallet addresses that hold a specific token. The derivation process involves the comparison of present prices with the average cost incurred in acquiring said tokens.

The historical Input-Output Market Analysis Pool (IOMAP) data presented below indicates that a significant proportion of the existing ENJ, MANA, AXS, and SAND holders are currently experiencing negative returns.

Among the prominent metaverse initiatives, it is observed that the holders of Axie Infinity and The Sandbox are currently experiencing comparatively less favorable outcomes.

Axie Infinity, an online video game developed by Sky Mavis, has gained recognition for its previously vibrant in-game economy, which operates based on non-fungible tokens (NFTs). According to the historical data provided by IntotheBlock, it is observed that a significant majority, precisely 99.54%, of the addresses that have acquired AXS are presently classified as being “out of the money.”

Metaverse investors lose a lot of money | Historical In/Out of Money info – AXS, SAND | Source: IntoTheBlock

Ranked closely behind is the Sandbox project, an immersive virtual environment that empowers players to construct, possess, and capitalize on their interactive gaming endeavors. A significant proportion of individuals, precisely 98.34%, who have invested in the SAND token are currently experiencing a decrease in the value of their investment.

In the current landscape, it is worth noting that investors in Decentraland and Enjin Coin have yet to achieve profitability.

Decentraland has garnered significant attention due to its dynamic virtual marketplace and community center, wherein individuals create, acquire, and trade digital real estate. As of September 1, 2023, it has been observed that a significant majority, precisely 89.04%, of investors who possess the native SAND token are currently experiencing negative returns.

Metaverse Investors Fall Deep into Losses | Historical In/Out of Money info – MANA, ENJ | Source: IntoTheBlock

The final component, the Enjin Coin ecosystem, offers a distinctive software solution enabling developers to effectively generate and oversee virtual assets within the Ethereum blockchain network. The native ENJ token holders have also experienced a comparable outcome. Approximately 75.5% of Enjin investors are experiencing a significant decline in their financial position.

Chances of a Comeback Seem to Be Going Down

In approximately 22 months, the collective market capitalization of ENJ, MANA, AXS, and SAND has experienced a substantial decline of 92%, plummeting from an initial valuation of $16 billion to a significantly diminished figure of $1.23 billion. This downward trajectory occurred between November 2021 and September 2023. Furthermore, it is worth noting that there has been a significant decline in the prominence of metaverse tokens within the cryptocurrency sector, with a reduction of approximately 76%.

The launch of Apple’s Vision Pro and the positive remarks made by Mark Zuckerberg, CEO of Meta (formerly Facebook), have elicited a modest revival within the Metaverse industry during July 2023.

However, the current momentum is rapidly diminishing due to various factors. First and foremost, addressing the persisting concerns about security, long-term utility, and player retention is essential. Moreover, the United States Securities and Exchange Commission (SEC) has further exacerbated the challenges faced by the Metaverse.

In June 2023, legal action was initiated by the Securities and Exchange Commission (SEC) against Binance and Coinbase. In the filings, the regulatory body classified The Sandbox, Axie Infinity, and Decentraland as “securities.” Following the occurrence, the valuation of SAND experienced a decline of approximately 44%, AXS witnessed a decrease of 33%, and MANA observed a reduction of 40%.

In summary, the prevailing social sentiment about the Metaverse currently exhibits a predominantly pessimistic outlook. However, this situation may appeal to strategic investors seeking to capitalize on the current market downturn with the expectation of a subsequent recovery.