The European Central Bank’s recent significant step towards the introduction of a digital euro shortly necessitates the need for the nascent form of currency to demonstrate its value.

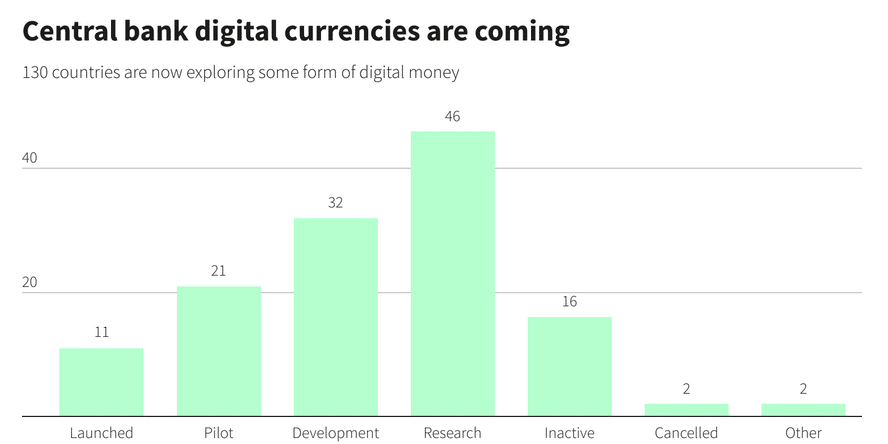

Several nations have implemented central bank digital currencies (CBDCs) in their monetary systems. Notably, China is currently conducting a trial of a prototype yuan, which has garnered a substantial user base of 200 million individuals. Additionally, India is preparing for a pilot program, while approximately 130 countries, collectively accounting for 98% of the global economy, are actively investigating the potential of digital cash.

The European Central Bank’s recent decision to initiate a pilot program to potentially introduce a digital currency for the 20 nations utilizing the common money marks a significant milestone. This development positions the ECB as the foremost Western central bank to actively pursue such an endeavor, potentially setting a precedent for global adoption.

Proponents argue that Central Bank Digital Currencies (CBDCs) possess the potential to revolutionize payment systems through enhanced features and offer a viable substitute to tangible currency, which appears to be experiencing a gradual decline.

However, inquiries persist about why Central Bank Digital Currencies (CBDCs) are regarded as a progressive development despite their limited adoption in countries like Nigeria. Additionally, protests have been against the European Central Bank’s (ECB) proposed implementation of CBDCs, indicating public apprehension regarding intrusive surveillance.

Commercial bankers express concerns regarding the potential costs and potential outflow of deposits as customers may opt to transfer their funds into central bank accounts. Simultaneously, developing nations harbor apprehensions regarding the possible disruptive effects of the widespread availability of a digital dollar, euro, or yuan within their respective financial systems.

What Does Money Represent?

According to Josh Lipsky, an expert in charge of a global CBDC tracker at the Atlantic Council, the ECB’s plan is of great significance and is receiving much attention from the international community.

The central bank in question holds a prominent position within the financial landscape due to its size. Should it successfully address concerns about privacy, cyber security, and offline usability, its impact and influence would be substantial.

Central banks were prompted to take action half a decade ago in response to Facebook’s proposal to introduce an independent form of currency. Currently, policymakers have yet to fully convince many individuals regarding the necessity of Central Bank Digital Currencies (CBDCs).

Implementing this initiative would strengthen the currency’s resilience against future challenges, according to Fabio Panetta, the Executive Board member of the European Central Bank in charge of managing the institution’s efforts related to the digital euro. Additionally, it would mitigate the excessive dependence on payment systems facilitated by credit cards originating from the United States.

However, professionals are currently perplexed and grappling with the situation.

As noted by Lee Braine, the managing director of advanced technologies at Barclays, who has actively participated in the Bank of England’s digital pound initiatives, the specific utility of a retail central bank digital currency (CBDC) remains uncertain in terms of offering unique functionalities that cannot be replicated by commercial bank money.

The individual expressed concern regarding the potential disruption to the uniformity of monetary units, highlighting the possibility of a dual-tier framework if Central Bank Digital Currencies (CBDCs) were to possess distinct functionalities or divergent regulations about data disclosure in comparison to traditional bank accounts.

The crux of the matter pertains to the fundamental nature and essence of currency.

Definition of an International Standard

One of the significant uncertainties pertains to the potential initiation of retail central bank digital currencies (CBDCs) by the United States Federal Reserve or the Bank of Japan.

Based on the comparative analysis of India and China, India possesses specific attributes that render it a potentially more productive test environment. Notably, both nations boast populations exceeding one billion individuals; however, India distinguishes itself through the presence of a comparatively more open economy.

In contrast, it is observed that Canada and certain other countries are exhibiting a cautious approach, while the majority of nations that have already implemented Central Bank Digital Currencies (CBDCs) are experiencing minimal levels of public engagement.

The data for the current month about the Bahamas, the pioneer of the inaugural digital currency in 2020, indicates a decline of 11% in personal transactions involving their SandDollar during the initial seven-month period of this year. Furthermore, there has been a substantial decrease of four times in the frequency of wallet top-ups.

The International Monetary Fund (IMF) published a paper in May that described the level of public adoption of the Nigerian naira as being “regrettably low” due to the astounding 98.5% of wallets that have remained empty and unused.

The current level of eNaira adoption is indicative of the early stages of Central Bank Digital Currency (CBDC) awareness, according to a written response from the nation’s central bank. The central bank further stated that this adoption level has aligned with anticipated projections.

Bo Li, a deputy managing director at the International Monetary Fund (IMF), stated that the organization is currently assisting numerous nations in their efforts to develop Central Bank Digital Currency (CBDC) initiatives. Furthermore, the IMF intends to release a comprehensive guide shortly, offering instructions and recommendations. The organization is currently in the process of developing its XC platform, which is specifically designed to facilitate the processing and settlement of Central Bank Digital Currencies (CBDCs) transactions.

The ECB and India’s technology choices, in Lipsky’s opinion from the Atlantic Council, have the potential to create a universal standard in a manner akin to how VHS influenced the early days of the videotape era.

According to Lipsky, improving the financial system is the main question about developing Central Bank Digital Currencies (CBDCs).