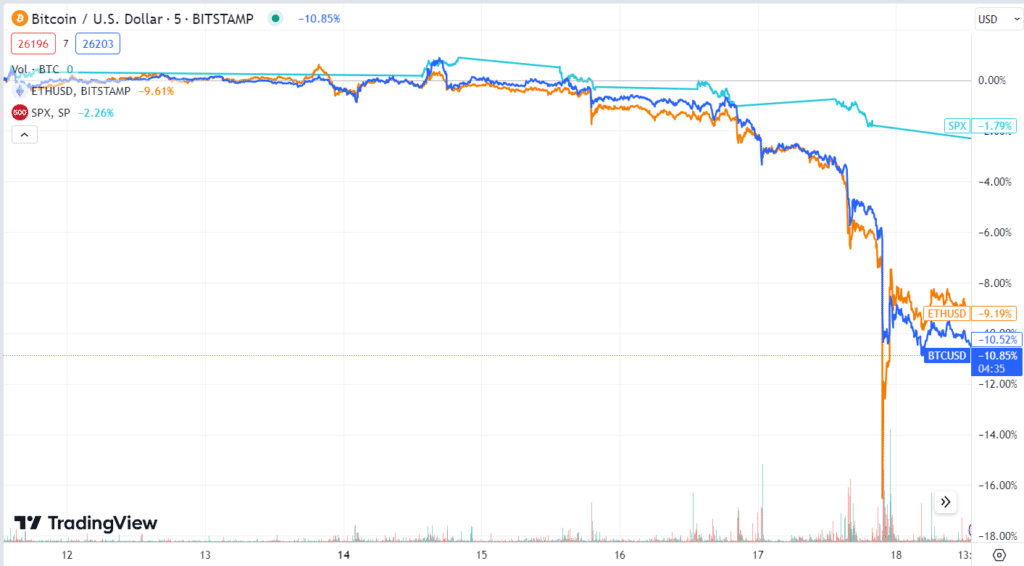

According to data from CoinMarketCap, the price of Bitcoin decreased by 10.44% from August 11th to August 18th, leading to a value of US$26,324 at 9:00 p.m. on Friday in Hong Kong. The leading digital currency about market value has been going through a continuous phase of trading beneath the mark of US$30,000 since the prior Wednesday. Ether’s price took a nosedive of 9.16% throughout the week, plummeting to a worth of US$1,678.

On Friday, the price of Bitcoin experienced a decline, reaching a value of US$25,409. This represents the lowest price observed in two months. The previously mentioned decline can be ascribed to the recent insolvency protection submission made by Evergrande, a notable Chinese real estate developer. With liabilities exceeding US$340 billion, Evergrande’s decision to seek bankruptcy protection in the U.S. aligns with its ongoing efforts to restructure its operations and address its obligations to international creditors. In 2021, Evergrande experienced a default on its dollar-denominated debts.

As per Adrian Fritz, the parent organization of 21Shares, a notable provider of cryptocurrency exchange-traded products, the decrease in Bitcoin’s value can be ascribed to the influence of Evergrande’s insolvency, alongside the customary occurrence of diminished trading movement during the summer season.

Bitcoin’s initial critical support level was identified as the 200-day moving average, situated at US$27,200. Regrettably, the cryptocurrency failed to sustain its position above this level. According to Fritz, it is advised to closely monitor the forthcoming significant support level, estimated to be approximately US$25,000.

Coinbase, the leading cryptocurrency exchange in the United States, made an official announcement on Wednesday regarding its successful acquisition of regulatory approval. This approval grants Coinbase the authority to provide eligible clients in the country with the opportunity to engage in crypto futures trading services.

Token holders of the Shiba Inu (SHIB) could use Thursday as the official launch day for utilizing the Ethereum network’s Shibarium layer-2 scaling solution. However, as revealed by the highly regarded on-chain intelligence outfit PeckShield, US$1.7 million worth of ETH has hit a snag on the Shibarium bridge. The tragic event has caused the price of SHIB to drop by nearly 7%.

The announcement made by Binance followed the listing of Europe’s inaugural Spot Bitcoin exchange-traded fund (ETF) on Euronext Amsterdam. This significant development occurred approximately two years after its initial approval.

According to Lucas Kiely, the individual serving as the chief investment officer at Yield App, a digital asset platform, the listing of the ETF has the potential to catalyze for other European nations to emulate this action. Furthermore, it may pressure the U.S. Securities and Exchange Commission, urging them to expedite the approval process for pending ETFs.

If Europe were to provide evidence of the safe operation of such products within the confines of established regulatory frameworks, it could potentially compel the SEC to reassess its prudent stance on investment vehicles associated with cryptocurrency. Kiely further opined that the escalating demand could exert upward pressure on Bitcoin prices.

The European ETF is not expected to significantly affect Bitcoin prices or speed up the decision process of the Securities and Exchange Commission (SEC), says Jonas Betz, a well-known analyst and founder of Betz Crypto, a famous consultancy business.

According to Betz, it is anticipated that the Securities and Exchange Commission (SEC) will uphold its autonomy and exercise its discretion, irrespective of the actions undertaken by its European counterparts.

Notable Gainers: Litecoin and Ripple

Several widely used cryptocurrencies experienced significant losses this week, drawing attention to their declining value.

XRP, a cryptocurrency ranked fifth in market capitalization, experienced a significant decline of 20.09%, reaching a value of US$0.505. This decline occurred after the Securities and Exchange Commission (SEC) was granted permission to file an interlocutory appeal in its ongoing legal dispute with Ripple Labs.

Litecoin, a cryptocurrency ranked as the 15th largest in market capitalization globally, experienced a significant decline of 21.65% to reach a value of US$65.12. This decline aligns with the overall downward trend in the broader cryptocurrency market.

According to data from CoinMarketCap, the global cryptocurrency market capitalization registered a value of US$1.06 trillion on Friday at 9:00 p.m. in Hong Kong. This figure reflects a decline of over US$100 billion compared to the previous week.

Will Bitcoin Be Able to End the Week at a Price Higher Than Us$27,000?

On Tuesday, investors will anticipate the speeches to be delivered by Austan Goolsbee, the President of the Federal Reserve Bank of Chicago, and Michelle W. Bowman, a Member of the U.S. Federal Open Market Committee.

Notwithstanding the decline of Bitcoin to a two-month nadir on Thursday, Kiely from Yield App asserts that the prevailing circumstances are not entirely characterized by pessimism and despair.

According to Kiely, the recent approval of Europe’s inaugural Bitcoin ETF signifies a significant development. Should Bitcoin conclude the week in the vicinity of US$27,000, it would position itself favorably to reestablish positive traction.