Tether is about to join the $ 100 billion club, an elite group of highly esteemed cryptocurrency projects.

Throughout history, there have been only four cryptocurrencies that have achieved this impressive milestone: bitcoin (BTC), ether (ETH), XRP, and Binance coin (BNB).

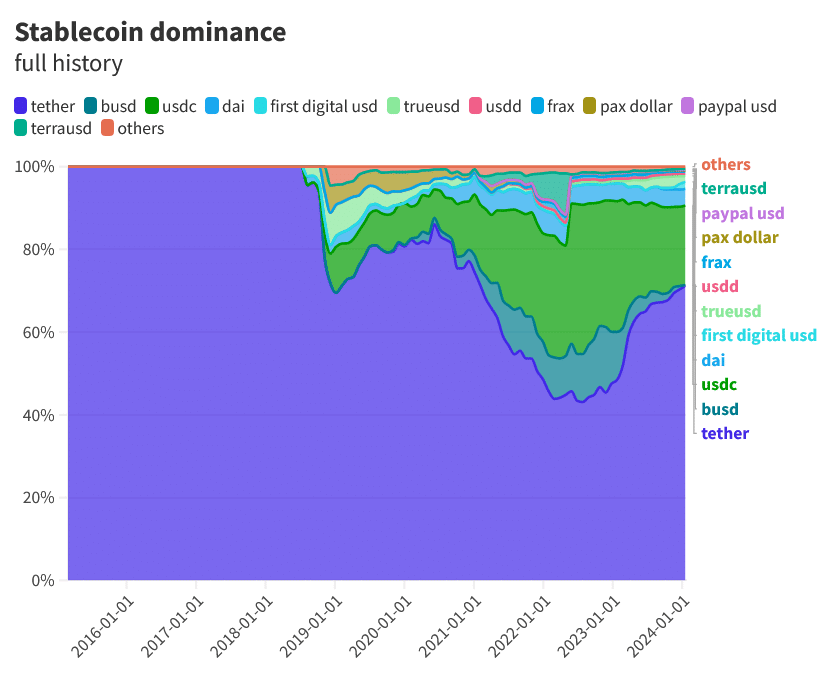

With a market capitalization of $95 billion, the Tether is poised to become the pioneer stablecoin to achieve this milestone.

An Elite Club for Only Select Cryptocurrencies

Bitcoin surged past the milestone in October 2017, making its way towards the unprecedented value of $20,000. Ether came on board a few months later, joining XRP. However, the latter quickly slipped back below.

During the recent cycle, BNB experienced a significant surge, nearly surpassing $110 billion in November 2021, following Bitcoin’s record-breaking peak. It swiftly exited the club. Now, just bitcoin and ether are left.

Several other digital currencies have come remarkably close. During the previous bullish period, Cardano (ADA) achieved an impressive market cap of $95 billion, while dogecoin (DOGE) came close to reaching $89 billion a few months prior.

Solana experienced a significant surge in value, reaching a staggering $77 billion, during the notable bitcoin pump over two years ago, when bitcoin was priced at $69,000. Despite a strong rebound in the past eight months, its current value is only half of what it used to be.

The chart below illustrates the market capitalizations as if they were all initiated simultaneously, with the exception of specific projects that lack data from their initial months.

Stablecoins such as Tether stand apart from other digital currencies as their market caps are calculated by multiplying the token prices with their moving supplies.

The prices of cryptocurrencies such as bitcoin and ether are determined on crypto exchanges. Every token in the Tether portfolio, which primarily consists of US Treasurys, has a fixed value of $1, and USDT is no different.

Stability Continues to Draw Investors’ Attention to USDT

Markets typically believe that each USDT is worth $1 as long as Tether exchanges tokens for real US dollars.

The stability of USDT’s peg occasionally fluctuates on specific exchanges, just like other cryptocurrencies, which tends to attract a lot of attention. These scenarios primarily demonstrate the liquidity of those sites rather than the intrinsic value of Tether itself.

Therefore, the USDT token is typically regarded as wholly supported as long as the worth of Tether’s portfolio surpasses the supply. This explains their recent move towards highly liquid, short-term US Treasurys.

Considering this, the market capitalization of USDT remains consistently aligned with its circulating supply, which fluctuates based on the demand from prominent investors, market makers, providers of liquidity, and other participants in the ecosystem.

Tether offers the direct sale and lending of USDT. The company has traditionally destroyed inventory during periods of low demand and created fresh tokens when demand rises.

USDT is widely used in numerous pairs throughout the crypto space and is the most actively traded cryptocurrency in the market. According to CoinGecko, it currently boasts a daily trading volume of approximately $45 billion.

Tether was actively producing new currency as markets anticipated the authorization of spot bitcoin ETFs in the United States.

In October of last year, approximately $85 billion USDT was in circulation. This indicates that Tether has generated over $10 billion within three months. Bitcoin has surged by an impressive 60% during that period.

Regardless, if Tether were to reach the $100 billion mark, it would set a new record as the crypto project with the longest journey to achieve such a milestone.