During the year 2023, the cryptocurrency markets experienced a remarkable and emotional rally, which can be predominantly attributed to the favorable and ameliorating state of the global economy, as well as a notable upsurge in investors’ risk appetite. Bitcoin (BTC), the revolutionary decentralized cryptocurrency, has emerged as a prominent digital asset, captivating widespread interest owing to its remarkable surge in value and growing institutional recognition.

Amid ongoing market fluctuations, it is worth noting that Ethereum (ETH) has experienced a discernible upswing in its performance. However, this positive trajectory has been eclipsed by the overwhelming dominance of Bitcoin, prompting individuals to contemplate the underlying factors contributing to Ethereum’s comparatively subdued performance throughout the year.

To obtain expert insights on the subject, the esteemed finance platform Finder sought the counsel of 32 distinguished individuals specializing in financial technology and cryptocurrency. These experts were approached to provide their prognostications regarding the year-end price projections for Ethereum, resulting in a collection of remarkably optimistic expectations for the esteemed digital asset, which currently holds the position of the world’s second-largest cryptocurrency.

Ethereum (ETH) is projected to conclude the year at a price point of $2,451. This forecast suggests a notable surge of over 30% in value compared to the present valuation of this particular cryptocurrency. According to financial experts, Ethereum is expected to reach its peak of $2,700 in 2023.

The future forecasts pertaining to Ethereum exhibited an even greater degree of optimism and positivity. According to a group of esteemed analysts, it is anticipated that the value of ETH will surge to an impressive $5,845 by the conclusion of the year 2025. Furthermore, an astonishing projection of $16,414 is predicted to be reached before the culmination of the year 2023. These estimations indicate a remarkable potential for growth, with a prospective upside of over 780% throughout the remainder of this decade.

Observations Made by Specialists About ETH

The group of 29 attendees included several notable figures in the financial industry, such as Mitesh Shah, who is the CEO of Omnia Markets, Tommy Honan, who is the head of product at Swyftx; and Ben Ritchie, who is the managing director at Digital Capital Management.

In terms of Shah’s end-of-year projection for ETH, it is worth mentioning that it aligned harmoniously with the collective estimates of the panel. However, it is noteworthy that Tommy Honan from Swyftx exhibited a slightly more optimistic stance regarding Ethereum’s immediate future.

Ethereum continues to captivate the attention of both retail and institutional investors, emerging as a prominent alternative investment option. After the remarkable transition to proof of stake, likened to the daring act of replacing a jet plane engine while soaring through the skies, ETH has witnessed enhanced efficiency and a deflationary nature, among other notable attributes,” the individual expressed.

– exclaimed Shah

On the opposing end, Ben Ritchie expressed a more prudent stance regarding their projections for ETH. The escalating expansion of centralized staking solutions within the crypto realm primarily influenced this.

The inherent decentralization of Ethereum holds immense potential, but it is crucial to acknowledge our concerns amidst the growing prevalence of centralized staking solutions. While offering certain advantages, these solutions pose a significant risk to the network’s decentralized fabric.

– Ritchie noted

Regarding the collective sentiment expressed by the panel, a significant proportion, precisely 56%, have opined that the present moment presents a favorable opportunity for acquiring ETH, the esteemed cryptocurrency. Conversely, 41% of the panel members have advocated for retaining their current holdings, while 4% have suggested parting ways with their ETH assets through selling.

Ethereum Price Analysis

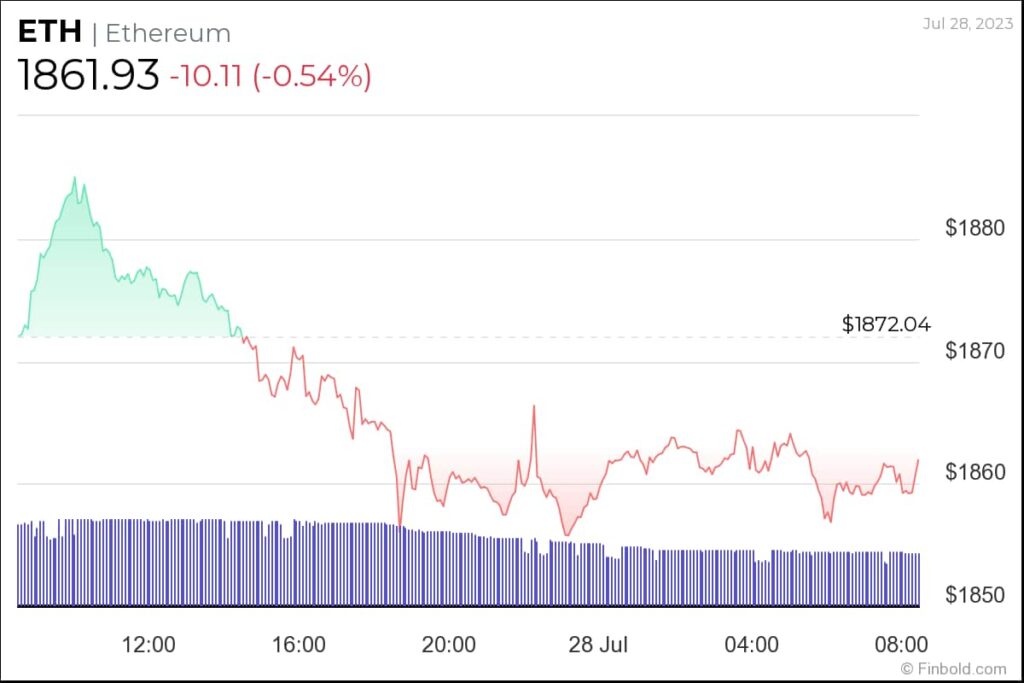

At the time of writing, the price of ETH stood at $1,861, reflecting a 0.54% decrease throughout the day.

The crypto asset experienced a modest decline of approximately 1.6% over the previous week, while its monthly price exhibited a relatively stable trend.

However, Ethereum (ETH) has experienced a remarkable surge of more than 55% since the beginning of this year, propelled by a widespread resurgence in the crypto market.