- The price of Ethereum is currently facing a significant hurdle at $2,600 as it strives to recover from the losses incurred during Monday’s crash.

- The amount of ETH staked has risen to 34.12 million, showing resilience despite the recent drop in price to $2,111.

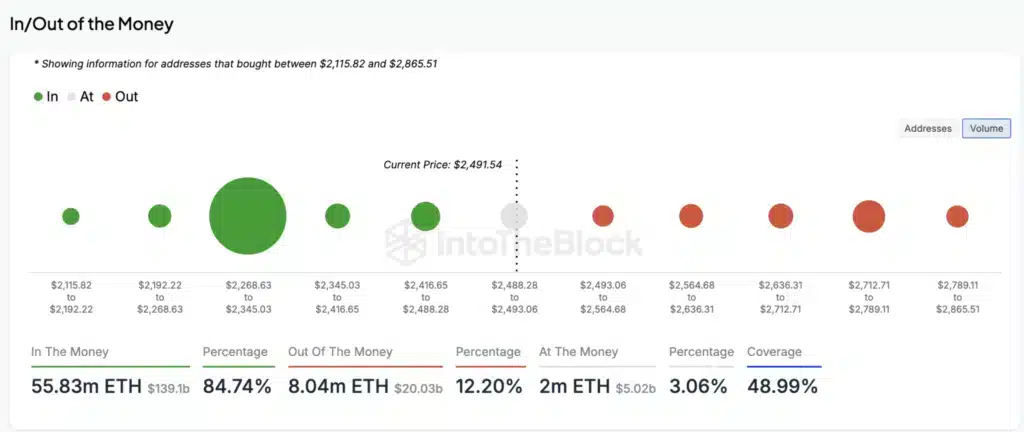

- The IOMAP indicates a strong level of support at $2,300, with a significant volume of 50 million ETH.

- There is still a possibility of a correction towards the $2,000 support level, considering the obstacle at $2,500.

The unexpected event on Monday affected the entire cryptocurrency market and resulted in significant liquidations and financial losses. As a result, the price of Ethereum has been experiencing a surge in momentum. It is imperative that the bulls demonstrate their power by surpassing a critical resistance level to maintain the current trend. This is the case despite the fact that the price of ETH has recently increased.

Ethereum’s Price Remains Stable as the Amount of Staked Eth Reaches an Impressive 34.12 Million

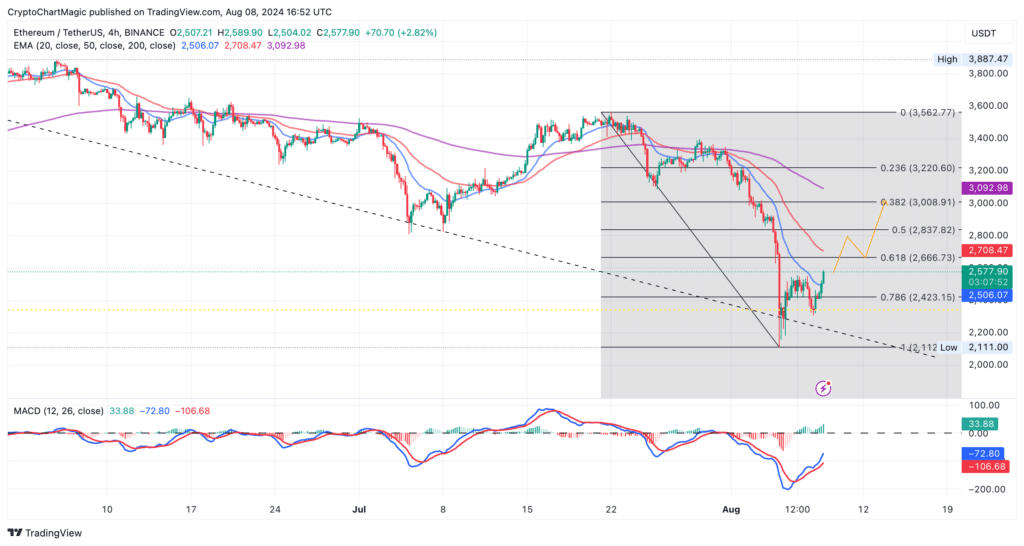

After making a significant comeback from its low point of $2,111 on Monday, the price of Ethereum continued to remain higher than $2,600. The upward movement reached $2676 on Friday, but market volatility caused a correction, which caused the price of ETH to test support at $2,330. This was the final point of the upward movement.

It would appear that traders are waiting for additional validation before fully committing to long positions in Ethereum. Ether is exhibiting a positive outlook, particularly with on-chain data from IntoTheBock indicating a rise in staked ETH to 33.65 million. This is particularly significant when considering the fundamentals of Ether.

There was a significant amount of 27,000 ETH was deposited into the smart contract during the crash that occurred on Monday, but only about 2,600 ETH was taken out of the contract. The unwavering determination of investors was evidenced by the deposits of 31,000 and 46,000 ETH, respectively, that were made on Tuesday and Wednesday. Indicating that holders have a bullish long-term perspective on the price of Ethereum, a higher staking balance suggests that they have a better outlook.

Staked ETH chart | IntoTheBlock

The price of ether is hovering between $2,268 and $2,345 at the moment, indicating that it is firmly established on a solid foundation. Throughout this period, approximately 2 million addresses acquired 50 million ETH. The fact that this particular group of investors is not likely to sell in the near future increases the likelihood that the upward trend will reach $3,000. At the same time, the large quantity reduces the possibility of another market downturn, with the objective of achieving a price that is lower than $2,000.

Ethereum IOMAP model | IntoTheBlock

ETH Price Sees Strong Recovery, Aims for $3,000

As a result of a temporary pullback to gather liquidity at the support level of $2,330, the price of Ethereum is getting ready to test the resistance level of $2,600 once more. A positive outcome is suggested by a number of indicators, including the Moving Average Convergence Divergence (MACD) indicator.

If this Ethereum price prediction is correct, then there is a significant possibility that Ether will make a decisive move towards $3,000. This is because the resistance level at $2,600 will be overcome. While the 20-day Exponential Moving Average (EMA) provides immediate support at $2,505, there is additional support at $2,330. Additionally, there is additional backing at $2,330.

When it comes to Ethereum’s reaction to the resistance levels at $2,600 and $2,800, which are located in close proximity to the crucial 50% Fibonacci retracement, traders need to remain vigilant because of the potential impact of these levels. Expanding beyond these regions in an efficient manner will increase the likelihood of the price of ETH crossing the $3,000 threshold.

Ether price chart | Tradingview

Despite the optimistic outlook for Ethereum’s price, traders should remain cautious and consider various outcomes. This includes being prepared for a potential correction towards $2,000 if the resistance levels at $2,600 and $2,800 prove to be insurmountable. When open interest starts to rise but volume starts to decline, it can be an early indication of exhaustion. This should prompt a careful approach.