Nansen’s blockchain data analysts are looking back at the events leading up to FTX’s demise to see what went wrong. The inquiry will consider the $4.1 billion in FTT tokens transferred from the exchange to Alameda Research.

The Nansen study, made public by Cointelegraph, includes several valuable insights from the blockchain analytics industry. These details shed light on the relationship between the two groups that Sam Bankman-Fried co-founded. The former FTX CEO makes their first court appearance, where they will face many claims about the company’s dissolution.

It is widely accepted that the initial reports in September 2022 detailing the notable allocation of 40% of Alameda’s $14.6 billion assets in FTT tokens were the primary reason for the abrupt collapse of FTX.

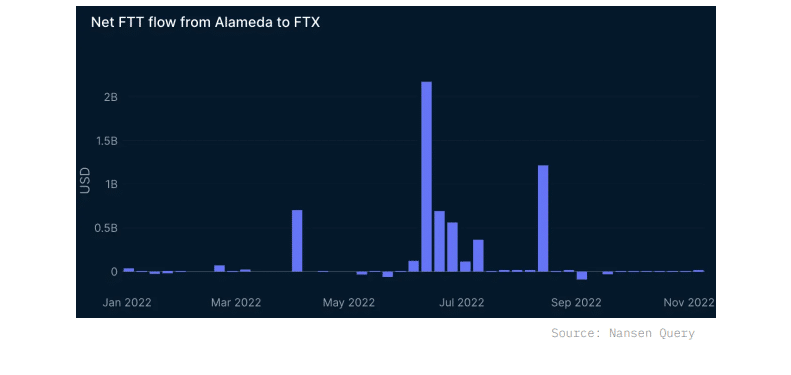

Before releasing this information, the Nansen researchers had already discovered shady on-chain communications between FTX and Alameda. There has been no release of these documents at this time. Between September 28 and November 1, Alameda executed many transactions, the largest of which involved the swap of FTT tokens worth $4.1 billion for FTX. Alameda also conducted several transactions for $388 million worth of dollar-pegged stablecoins.

According to the available on-chain information, FTX has almost 80% of FTT tokens (350 million) or 280 million tickets. Presently, there are 350,000,000 FTT tokens available for use. Based on the blockchain data, many wallets associated with FTX and Alameda are responsible for moving around large sums of FTT’s trading volume, which may total billions of dollars. These exchanges are also shown as having occurred.

In the words of Nansen, a considerable percentage of the FTT token supply has been subject to a contractual three-year vesting mechanism, including unsold company and non-company tokens. This structure applies to both company and non-company tokens. This stipulation has existed ever since token creation. The research team has determined that an Alameda-managed wallet is the sole recipient of the contract’s benefits.

According to Nansen’s assessment, the groups above may have provided mutual aid to one another to boost their financial standings. This is because the two companies above controlled a near-majority (90%) of the total available FTT tokens.

According to the probe, Alameda is suspected of participating in the black market trade of FTT tokens. It is also claimed that in addition to selling FTT tokens directly to customers, Alameda used these tokens as collateral for loans from cryptocurrency lending businesses.

Data from the past recorded on the blockchain lends credence to the idea above. This information demonstrates that significant money frequently moved between FTX, Alameda, and Genesis Trading wallets. There was a considerable increase in transfer volumes in December 2021, with as much as $1.7 billion changing hands.

The Alameda cryptocurrency exchange may have had liquidity challenges due to the collapse of the algorithmic stablecoin Terra/LUNA and the subsequent bankruptcy of 3 Arrows Capital (3AC). When the value of FTT began to fall, it triggered the secret issuance of a $4 billion loan secured by FTX. This led to the current problem.

The information now available on the blockchain suggests that this may have occurred. Approximately 163,000,000 FTT were transferred to FTX wallets from Alameda when the 3AC failed in the middle of June 2022. These wallets had a total value of almost $4 billion.

The authors of the research state that the loan amount of $4 billion provided by close personal friends of Bankman-Fried during an interview with Reuters is in line with the stated transaction volume of $4 billion.

According to the information in the blockchain, Alameda’s plan to purchase FTT tokens from Binance on November 6 for $22 was not viable and thus could not be carried out by the company. Following the public announcement by Binance CEO Changpeng ‘CZ’ Zhao, in which he communicated the intention of the exchange to dispose of its tokens, this decision was driven by the appearance of lousy information surrounding Alameda’s financial statement. This decision was spurred by the fact that Binance CEO Changpeng ‘CZ’ Zhao made the public announcement.