Bitcoin (BTC) and the cryptocurrency market as a whole are currently experiencing downward pressure. It is interesting to note that the very first digital asset is having difficulty maintaining trading levels that are higher than sixty thousand dollars, and there are market participants who anticipate further declines.

A cryptocurrency trading expert named TradingShot suggested in a post published on TradingView on May 10 that Bitcoin might experience additional losses as it deals with rejection at significant levels. This suggestion was based on several technical indicators.

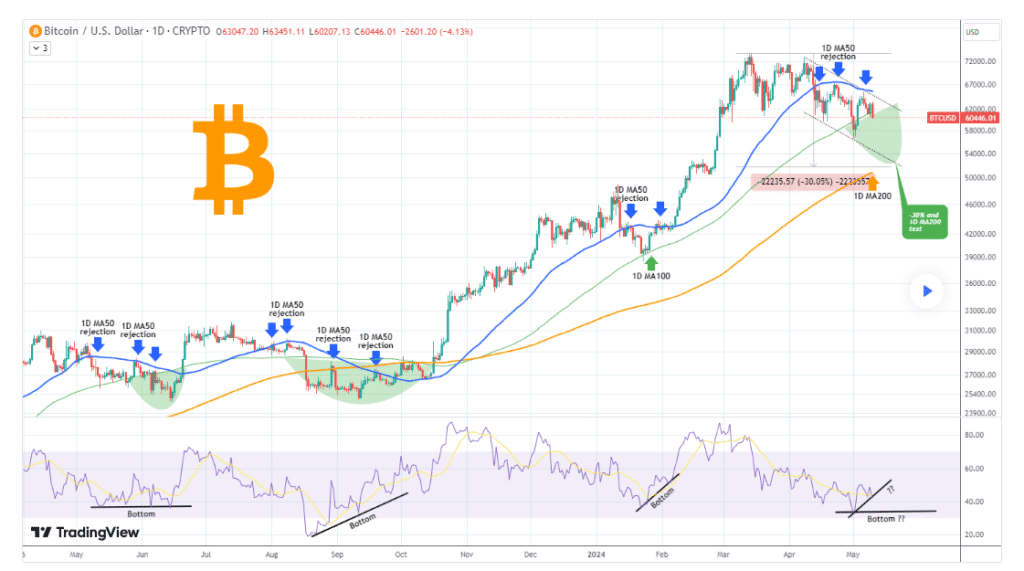

During Bitcoin’s recent price movement around the $65,000 position, the analyst observed that the price movement was hampered by multiple rejections at the one-day moving average 50 (1D MA50). After the downward breakout on April 13, this new development represents the third denial that occurred nearly a month later.

As a result, traders and analysts are worried about the market’s inability to maintain upward momentum beyond this crucial moving average.

Significance of Bitcoin’s Challenges

In addition, the analyst mentioned that Bitcoin’s recent decline has caused it to fall below the 1D MA100 by approximately $61,000, which is a significant level of support. This was brought to the attention of the analyst. According to the findings of TradingShot’s analysis, this circumstance could be better and has the potential to result in an additional drop in the price of Bitcoin.

Given that the technical structure that has been in place since April 8 indicates a Channel Down pattern, it is reasonable to assume that such an accomplishment is definitely feasible in the short term. According to data from the past, it is clear that Bitcoin has been subjected to a number of rejections since breaking below the 1D MA50. It has consistently remained below the 1D MA100 for extended periods, with the exception of January 2024, which deviated from this pattern.

Remarkably, the current situation is occurring because there is a possibility that Bitcoin will experience a significant decrease. If a new low is reached, not only will Bitcoin be able to challenge the 1D MA200, which is located somewhere around the $50,000 level, but it will also experience a drop of almost 30 percent from its previous all-time high of over $73,000 during this period.

TradingShot emphasized that this kind of decrease is typical during upward market trends, which suggests that Bitcoin’s current challenges could be the result of a more extensive market adjustment. Despite this, the signals from these technical indicators indicate that Bitcoin may experience additional downward movement in the near future. Investors and traders should keep this in mind.

The Optimistic Outlook for Bitcoin

It is essential to mention that Bitcoin is still firmly below the critical resistance level of $65,000 while the market eagerly awaits the start of the post-halving rally. In spite of the temporary optimism surrounding Bitcoin, the cryptocurrency has faced difficulties in gaining traction. It has been unable to take advantage of favorable developments, such as the recent disclosure of JPMorgan Chase’s involvement with ETFs.

Significantly, the factors impacting ETFs, such as the movement of funds in and out, have played a role in shaping the recent price movement of Bitcoin.

In spite of the prevailing cautious sentiment, there remains an underlying optimistic outlook within the market. Interestingly, Jack Dorsey, the previous CEO of Twitter (now X) and a well-known personality in the cryptocurrency industry, expressed positivity by predicting a possible skyrocketing of Bitcoin’s value to $1 million by 2030.

Furthermore, positive sentiment is strengthened by anticipation of the customary post-halving surge, a phenomenon that has historically infused a bullish drive into the price of Bitcoin.

Analysis of the Price of Bitcoin

As of the time of reporting, Bitcoin was being traded at $61,050, showing a slight correction of less than 0.1% in the last 24 hours. Nevertheless, Bitcoin has encountered a decrease of approximately 4% per week.

While Bitcoin is currently going through a phase of consolidation during unfavorable market conditions, investors must keep a close eye on the latest updates regarding Federal Reserve monetary policies. These policies have the potential to greatly impact various risk assets, including cryptocurrencies.