The Solana ecosystem is witnessing a significant upward trend, successfully navigating through the obstacles presented by the bear market. The noteworthy resurgence is characterized by a substantial increase in the value of SOL and an apparent change in market sentiment.

According to data provided by BeInCrypto, it has been observed that the value of SOL, the cryptocurrency associated with Solana, briefly reached the $60 threshold earlier today. This particular price point represents the highest level SOL has attained since May 2022.

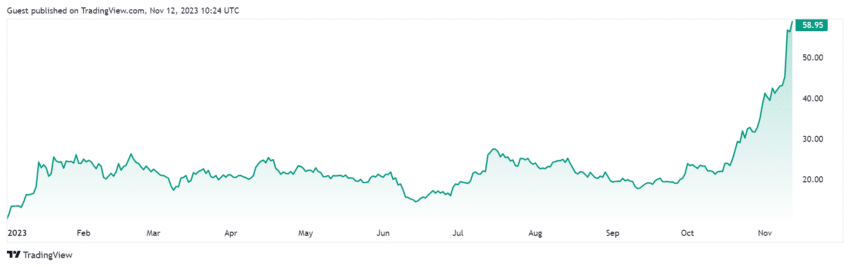

The Price of Solana (SOL) Has Increased Over 500% Year to Date

SOL has exhibited notable expansion, experiencing a surge of more than 178% within the previous month and an approximate 500% increase since the beginning of the year. This positions it in front of other prominent cryptocurrencies, like Bitcoin and Ethereum, which have likewise encountered favorable patterns.

An upswing in fresh users heightened liquidity, and a burgeoning curiosity in the Solana blockchain technology from prominent conventional institutions supplement this upward trend in price.

Price of Solana since the beginning of the year. Source: TradingView

Based on data obtained from DefiLlama, it has been observed that decentralized exchanges functioning on the Solana blockchain have achieved a trading volume exceeding $2 billion during the initial 12 days of the current month. This noteworthy accomplishment indicates the potential for an unprecedented month in terms of trading activity. In addition, the current amount of assets locked on the network has surpassed $500 million at the time of this update.

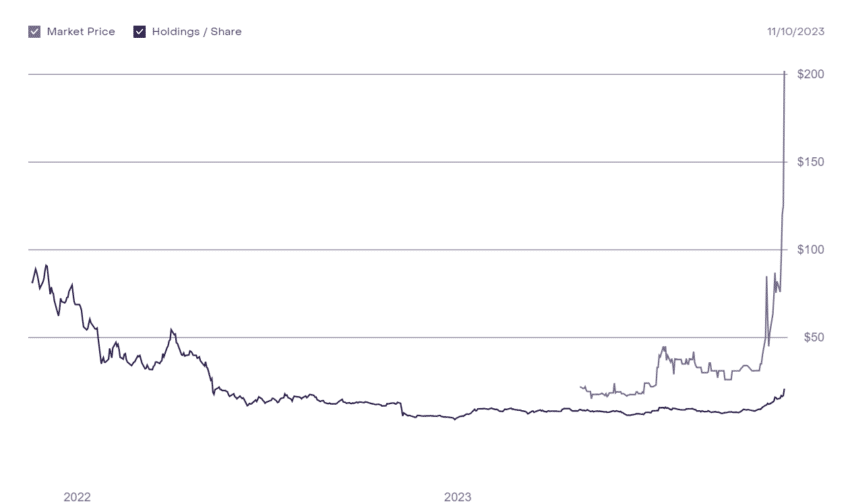

Grayscale Solana Trust at a Premium of 800%

The favorable market conditions have notably affected Grayscale’s Solana Trust (GSOL). According to available data, it can be observed that GSOL shares are currently being traded at a significant premium, surpassing 800%.

According to reports, the recorded transactions of Secondary SOL reportedly reached a peak of $202 on November 10th. This signifies a significant rise from the $20 assessment of initial transactions within the corresponding timeframe.

The Solana Trust operated by Grayscale. Source: Grayscale

The increase in demand highlights a rising curiosity among institutional investors in obtaining access to Solana. According to the American Association of Individual Investors (AAII), GSOL offers a reliable opportunity for investors to participate in the ecosystem while minimizing the associated risks.

Significantly, the high-level trading of GSOL coincides with the popularity of other Grayscale products currently garnering significant interest from investors. The increased attention results from widespread beliefs surrounding the possible authorization of a Bitcoin exchange-traded fund (ETF) in the United States.

Presently, premiums exceeding 100% are observed in the Trusts for various digital assets managed by Grayscale. These assets include Chainlink, Filecoin, Decentraland, Stellar Lumens, and Basic Attention Token.