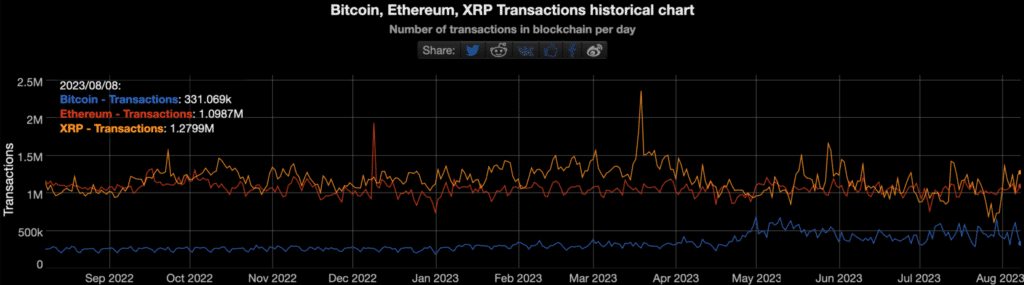

The XRP Network (XRP) and the Ethereum Network (ETH) have emerged as prominent players in the vast realm of cryptocurrency networks. The significant daily transactions between Ethereum’s blockchain and Ripple’s public ledger show that these networks have attracted much attention due to their remarkable usage. A quantifiable measure that accurately captures the level of interest and needs for their cutting-edge technological solutions.

According to recent data analysis, it has been observed that on August 8, the XRP Ledger witnessed a substantial volume of approximately 1.28 million daily transactions. In contrast, Ethereum recorded a slightly lower figure of 1.09 million transactions during the same period. These statistics, sourced from BitInfoCharts, shed light on the comparative transactional activities within the crypto realm. The prominent digital currency, Bitcoin (BTC), which holds a significant position in cryptocurrencies, currently lags in transaction volume. With approximately 0.33 million transactions on its blockchain, Bitcoin showcases its enduring presence in the ever-evolving landscape of decentralized digital assets.

The ongoing battle for supremacy in network utilization, specifically in transaction volume, has been a fiercely contested affair that spanned a considerable period. XRP and Ethereum, two prominent cryptocurrencies in the market, have experienced notable fluctuations in their value over time. In the case of XRP, it encountered a significant decline in July, which has since been mitigated through subsequent market movements.

Based on recent data, the XRP Network has recorded an average of 53,330 transactions per hour over the past 24 hours, while the Ethereum Network has achieved an average of 45,900 transactions per hour. The average hourly yield of the Bitcoin Network stands at 17,288 units.

The Total Volume of Transactions for XRP, ETH, and BTC

In contrast, the scenario reverses when considering the transmitted volume during the timeframe above.

- Bitcoin: 280,266 BTC ($8.35 billion) — A modest 1.44% of the market cap.

- Ethereum: 992,507 ETH ($1.84 billion) has been recorded. — A mere 0.7812% of the overall market capitalization

- XRP: 749,743,000 units of XRP ($0.48 billion) — The market cap has experienced a growth of 1.41%.

Bitcoin reigns supreme in digital assets, commanding a significant share of US dollar (USD) volume and a notable portion of the market cap. On the other hand, XRP, while trailing behind Ethereum in USD volume, exhibits remarkable proximity to BTC when considering market value. The 24-hour transactions volume for the XRP Ledger was sourced from Blockchain due to the unavailability of this metric on BitInfoCharts.

Analysis of the XRP Pricing

At the same time, the price of XRP has increased by 4.60% since the beginning of the day to reach $0.64 per coin, and is currently trading hands.

Since August 1, prices have remained within this range consistently. On July 13, the cost of XRP had a tremendous pump, going from $0.47 to $0.81, an increase of 72%; nevertheless, it is steadily reverting to the current zone.

If the XRP network had the same completely diluted market capitalization as Ethereum’s, one XRP would be worth $2.24. This is based on the demand for the number of transactions to be comparable to that of Ethereum’s network and the need for the volume of transactions to be superior to that of Ethereum’s network.

When everything is considered, the digital asset’s potential to satisfy these expectations will depend on future developments about XRP and Ethereum and the overall opinion towards the larger crypto and macroeconomic landscape.