Following news of Nvidia’s 211% increase so far this year, the IT industry is optimistic. The increasing popularity of AI is mainly responsible for this expansion, incredibly generative AI applications and picture-generating services. This significant change has caused many people to feel shocked.

Nevertheless, it is worth noting that some industry insiders do not align with the optimistic outlook expressed. One of note is Samantha LaDuc, an astute observer of Nvidia’s financial undertakings, who has posed relevant inquiries about the company’s recent Q2 outcomes.

The individual in question has expressed significant apprehension regarding the company’s purportedly questionable expansion of revenue derived from its data center operations.

Skepticism Arose in Response to Nvidia’s Quarterly Results

One primary source of controversy surrounding Nvidia is the company’s decision to extend a $2.3 billion financing guarantee to CoreWeave, a niche cloud provider. Approximately 115.6 billion units of Nvidia stock are held by BlackRock, making it the third-largest shareholder and a substantial creditor in connection with this loan.

Collateral allocation and the depreciation rate relative to the payment schedule were the subject of negotiations between the relevant parties. CoreWeave’s CEO, Michael Intrator, claims that going outside the company for financing is the most effective way to do so.

Notable about this credit line is that it will finance an expansion to better meet the ever-increasing needs of artificial intelligence (AI) workloads, with the GPUs themselves used as collateral.

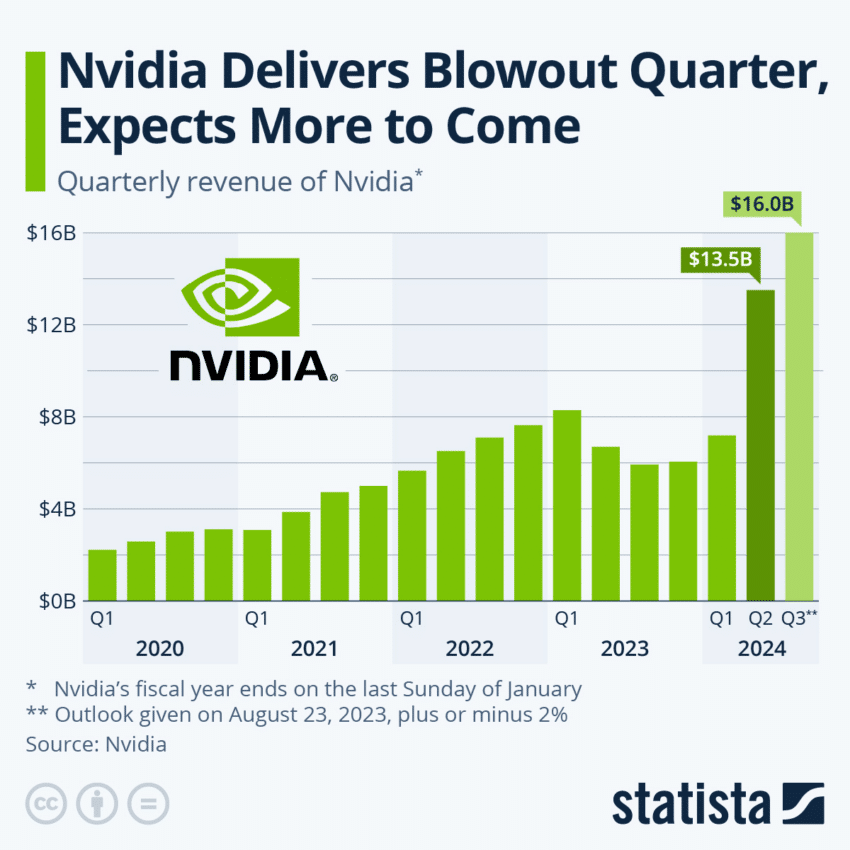

Nvidia’s server room income in the second quarter was the basis for the $2.3 billion credit. The company’s financial report indicates a notable achievement, with a recorded figure of $10.3 billion. This represents a substantial growth of 141% compared to the previous quarter and a significant surge of 171% compared to the corresponding period in the last year.

Quarterly Reports from Nvidia. Source: Statista

While the aforementioned financial tactics adhere to legal parameters, they have undeniably elicited concerns regarding Nvidia’s ethical conduct.

The observed accounting method exhibits characteristics that may be deemed suspicious as it deviates from regular practices. It is important to note that this method aligns differently from the conventional concept of channel stuffing, which typically involves a contrasting approach. There exists a substantial disparity between the prevailing demand and the available supply.

Numerous stakeholders are involved at various hierarchical strata, encompassing Nvidia’s ownership and CoreWeave. The alignment between the line of credit’s backing and the magnitude of its size coincides with the surpassing of its data center earnings. The closed-loop system is indeed comprehensive, as affirmed by LaDuc.

The decision to collateralize a line of credit with Nvidia’s GPUs entails inherent risks due to the expeditious obsolescence commonly associated with technological devices. Upon reflection, the unfavorable outcome stemming from implementing the financial strategy undertaken by the crypto exchange FTX is worth noting.

It has been claimed that former FTX CEO Sam Bankman-Fried mixed customer money with those of counterparties and made transactions without clients’ knowledge or permission. It’s also worth mentioning that the FTT cryptocurrency, created by the exchange, was used as collateral in several of these leveraged deals.

Like FTX and Alameda Research’s effects on the digital currencies market, the links between Nvidia and CoreWeave’s financial operations have resonated across the financial industry.

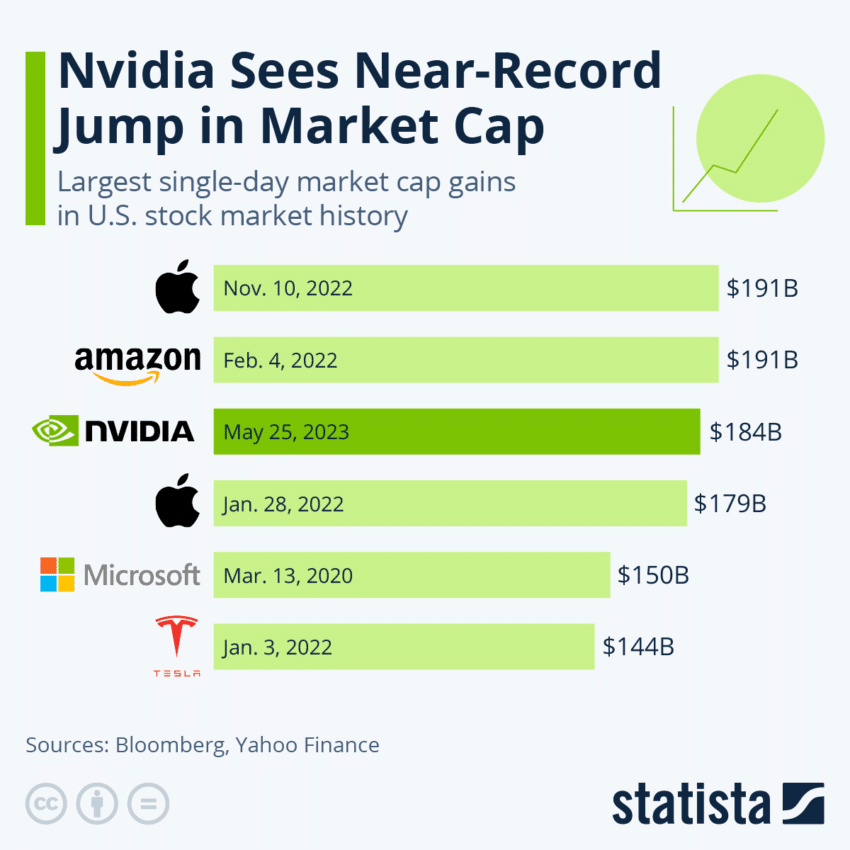

The stock market’s mood was noticeably affected by Nvidia’s considerable expansion in 2023, which resulted in a significant gain of $836 billion in its market value. The widespread use of AI has been a driving force behind the expansion of the technology sector. Unintentionally promoting a bubble phenomenon, the observed exponential growth may obscure the need for creative Intelligence.

Some Analysts Believe Nvidia Might Go Bankrupt

The remarkable rise of Nvidia has attracted significant interest from investors and industry professionals. The prevailing enthusiasm surrounding this bullish sentiment has reached such an extent that numerous individuals have disregarded the inherent risks associated with market bubbles.

The escalating valuation of Nvidia has prompted apprehensions regarding the emergence of a prospective market bubble.

Rob Arnott, the esteemed founder of Research Affiliates LLC, provided a thought-provoking and reflective viewpoint. With a notable year-to-date surge of 211%, Nvidia is positioned at the forefront of the ongoing computer science revolution. However, Arnott provided an analysis that characterizes the stock as a quintessential exemplification of a pervasive market delusion.

Nvidia’s valuation indicates a prevailing conviction in the enduring dominance of its GPU architecture, with a perceived immunity to displacement by emerging competitors or internal initiatives within other artificial intelligence companies. Furthermore, it suggests that prevailing market expectations are still inflated.

The phenomenon of overconfident markets manifests paradoxically, wherein the exceptional potential of future business prospects is translated into even more remarkable levels of current stock prices. Nvidia stands as a contemporary exemplification of the category above, representing a formidable entity that currently exhibits a valuation that surpasses the bounds of rationality,” Arnott asserted.

Nvidia Single-Day Market Cap Gains. Source: Statista

It has been observed by Arnott that a potential decline in the value of Nvidia has the potential to trigger a more extensive market downturn. The individual, renowned for their strong perspectives on the possibility of market bubbles, underscored the dangers associated with disregarding historical trends.

It is worth noting that the duration of the unfolding of accurate narratives may exceed the initial expectations of the majority of investors. The prevailing sentiment among investors is that the probability of upside uncertainty regarding future growth outweighs that of the downside. According to a commentator during the 2020 dot-com bubble, it was observed that tech stocks were valuing all potential future growth and beyond, as stated by Arnott.

Contributing to the prevailing narrative are recent disclosures revealing that Jensen Huang, the Chief Executive Officer of Nvidia, executed a substantial sale of shares. The individual in question exercised stock options for a total of 29,688 shares, divided into two separate batches. The exercise price for each share was set at $4.

Records show that Huang properly exercised the aforementioned options, resulting in the acquisition of the corresponding number of common shares. During the time period of September 1st to September 6th, three independent and unique choices exercises took place.

Subsequently, the aforementioned acquired shares were divested by Huang in three distinct tranches over the identical time frame. The observed range of the sale price for the aforementioned shares exhibited variability, oscillating between $466.13 and $497.17. Upon careful examination of the company’s disclosed financial information, it has been determined that Mr. Huang’s earnings for each of the aforementioned three periods totalled approximately $14 million, resulting in a cumulative gain of approximately $42,828,053.

Given the complex nature of the financial maneuvers surrounding Nvidia, it is of utmost importance for investors to exercise prudence and approach the situation with a discerning mindset. As evidenced by historical precedent, the absence of prudent caution can serve as a catalyst for the emergence of speculative bubbles, wherein even prominent entities within an industry are not impervious to the ensuing consequences.