BNB, the native token of the BNB Chain, surged to its highest point ever at $723 on June 6 before experiencing a slight correction to $705. In spite of this correction, BNB has achieved a remarkable 19% increase in the initial six days of June, far surpassing the 4.2% gain observed across the entire cryptocurrency market in the same timeframe. Traders are currently pondering the long-term viability of this rally and seeking signs that could bolster the positive momentum for the BNB price.

The Imprisonment of Binance’s Founder Has Had a Detrimental Impact on the Price of BNB

Changpeng “CZ” Zhao, founder and former CEO of Binance exchange, was transferred to a federal prison in California on June 1 to begin his four-month sentence for charges related to money laundering. Surprisingly, the BNB rally happened at this time. With his incarceration, CZ is far less likely to interfere with Binance’s goals and administration, even if consequences were widely expected following the court’s judgment on April 30.

Put another way, BNB’s current market capitalization of $108 billion is 37% greater than its competitor Solana’s $79 billion, regardless of the rationale behind the price jump. It’s essential to look at whether the two token ecosystems are valued that much differently. But, the discounts offered by Binance services and the chance to access special deals like Binance Launchpad contribute to BNB’s value.

The durability of BNB’s climb above $710 may be better understood by comparing its behavior to that of Ethereum, the leading platform for decentralized applications (DApps). However, because of the low costs of the BNB Chain, it might take a lot of work to conduct reliable comparisons across other chains. Unfortunately, its semi-centralized structure may also make it vulnerable to data tampering, but it also allows for these cheap costs.

Open Interest for BNB Futures Surpasses the Impressive Milestone of $1 Billion

Several experts have proposed that the surge in BNB value was primarily driven by an abundance of leverage utilized by buyers through derivatives. This may have been influenced by traders succumbing to FOMO and employing excessive leverage when making purchases. Nevertheless, the theory is refuted by evidence, as it gained traction following the unprecedented occurrence of BNB futures open interest surpassing $1 billion on June 6.

Open interest in all BNB futures contracts in USD. Source: Coinglass

Although it does determine the total number of available contracts, the futures open interest does not reveal whether buyers (longs) or sellers (shorts) are seeking further leverage. There must be an identically sized and valued buyer and seller in every derivatives contract. For the contract to be valid, this must be done. Considering this, it would be incorrect to assume that the exceptional 18% gain in just six days was entirely due to the derivatives markets. Other variables certainly had a role as well.

If you want to discover how invested traders are in the market, you have to look into perpetual futures, which are also called inverse swaps. The built-in rate of these contracts is revised every eight hours to correct imbalances in the degree to which leverage demand is being met. A positive rate suggests that purchasers are inclined to lend money via leverage.

It is worth noting that the funding rate has stayed below 0.03% for the last six days, which is the same as a weekly rate of 0.6%. Most traders should be able to afford this rate, experts say. Similar to Bitcoin (BTC) and lower than SOL’s present weekly financing rate of 0.5%, BNB’s rate is 0.2% at the moment. This is meant to be used as a benchmark for comparison. So far, it has yet to be proven that the recent surge in BNB futures prices above $710 was due to an over-reliance on debt.

BNB Chain Activity Is Strong but Not Enough to Support Pricing Increases

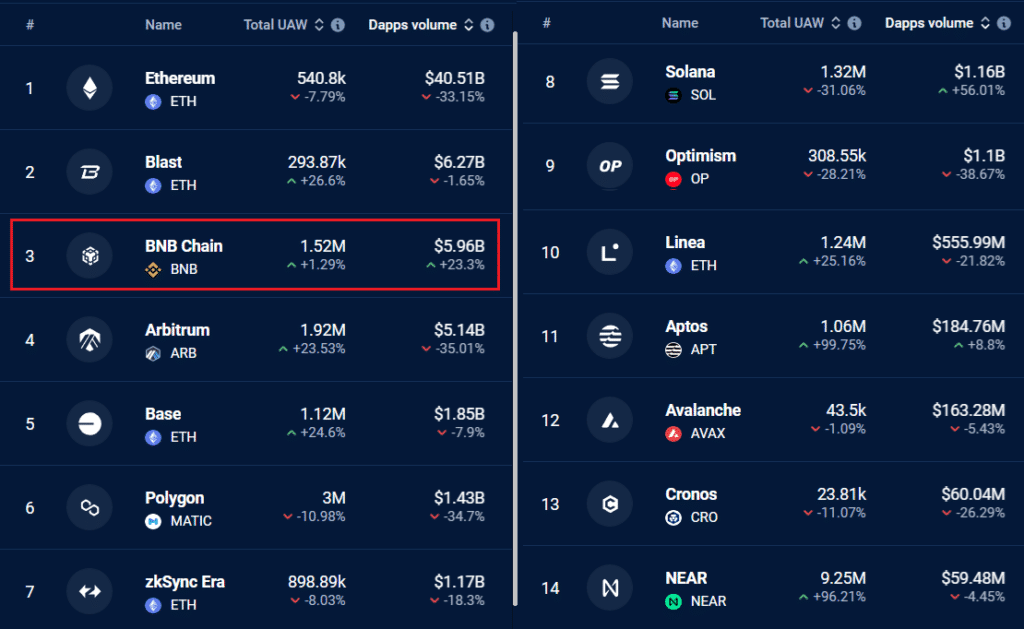

When it comes to DApps activity, BNB Chain continues to be one of the top 3 contenders in terms of volumes. On the other hand, Solana, a direct competitor, still needs to catch up and make it to the leaderboard.

Ranking of top blockchains by 7-day DApp volume, USD. Source: DappRadar

With a 23% increase in volumes over the past week, BNB has shown to be the preferred choice for DApps activity, according to current data. On the other hand, activity on most of the competing blockchains has been on the decline. However, questions about the natural growth of BNB Chain’s user base are raised by the steady number of active addresses participating in its DApps. Furthermore, Ethereum’s remarkable $40.5 billion activity during the same period is dwarfed by BNB Chain’s far lower seven-day volume of $6 billion.

BNB’s on-chain and derivatives data do not raise red flags, but there is no reason to think the price will rise, especially with CZ’s present detention casting doubt on Binance’s capacity to continue serving as the market leader.