An intriguing analysis of the relationship between Bitcoin (BTC) and gold was provided by a specialist in cryptocurrency trading. The analysis highlights the significance of the precious metal in influencing the forthcoming surge in cryptocurrency prices.

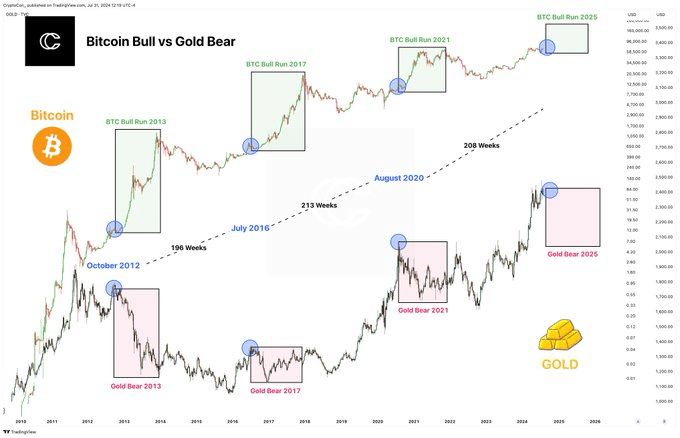

In a post published on July 31st, the cryptocurrency analyst CryptoCon mentioned that bull markets for Bitcoin have typically begun at the same time that bear markets for gold are in progress.

It is interesting to note that the rise of Bitcoin in 2013 coincided with the decreasing value of the gold market during that same period. In 2017, a similar pattern emerged, with Bitcoin experiencing a surge while the gold market experienced a decline. The inverse correlation between the rise of Bitcoin and the decline of gold was further strengthened by the fact that this pattern continued into 2021.

CryptoCon’s analysis revealed a consistent pattern in the timing of market shifts, with durations between one gold bear market and the next significant market movement averaging around 196 weeks and 213 weeks.

The Pivotal Moment for Bitcoin

It has been 208 weeks since the previous peak of the gold bear market in August 2020. Based on prior patterns, the market is reaching a crucial point, indicating that a significant change may be on the horizon.

According to the expert analysis, the upcoming decline in the gold market may potentially spark the subsequent surge in Bitcoin’s value.

Undoubtedly, both assets have been evaluated for their capacity to preserve wealth. Bitcoin enthusiasts firmly believe that cryptocurrency has the potential to replace traditional precious metals, leading to its nickname as ‘digital gold.’

Currently, gold is experiencing a solid upward trend as the metal soars past the $2,400 mark. Significantly, the metal surged following reports of geopolitical tensions in the Middle East involving Israel and Lebanon.

Analysis of the Price of Bitcoin

However, Bitcoin is currently facing negative market sentiment in the short term as it has dropped below the crucial support level of $67,000. Interestingly, the initial cryptocurrency was unable to surpass the $70,000 barrier, partially due to a decrease in specific spot Bitcoin exchange-traded funds (ETF).

At the time of publication, BTC was priced at $66,430, showing a daily increase of more than 1%. In the previous week, Bitcoin experienced a slight decline of approximately 0.2%.

The weekly chart of Bitcoin displays notable volatility, which is often driven by significant news events. Commencing at $66,680 on July 25, the price declined due to Mt. Gox creditors acquiring Bitcoin, leading to a state of uncertainty in the market.

Nevertheless, it made a remarkable comeback and reached its highest point above $69,000 on July 28, fueled by a series of encouraging developments, such as the introduction of Senator Cynthia Lummis’s regulatory legislation.