The recent performance of Bitcoin Cash (BCH) exemplifies a classic example of how investor emotions and large traders influence price movements in the short to medium term. There has been a notable surge in substantial transaction amounts and a considerable decline in weighted sentiment, indicating a pessimistic forecast for BCH.

BCH skyrocketed by 73.53% over the last month. Nevertheless, the movement of whales and the overall market sentiment suggest an upcoming correction.

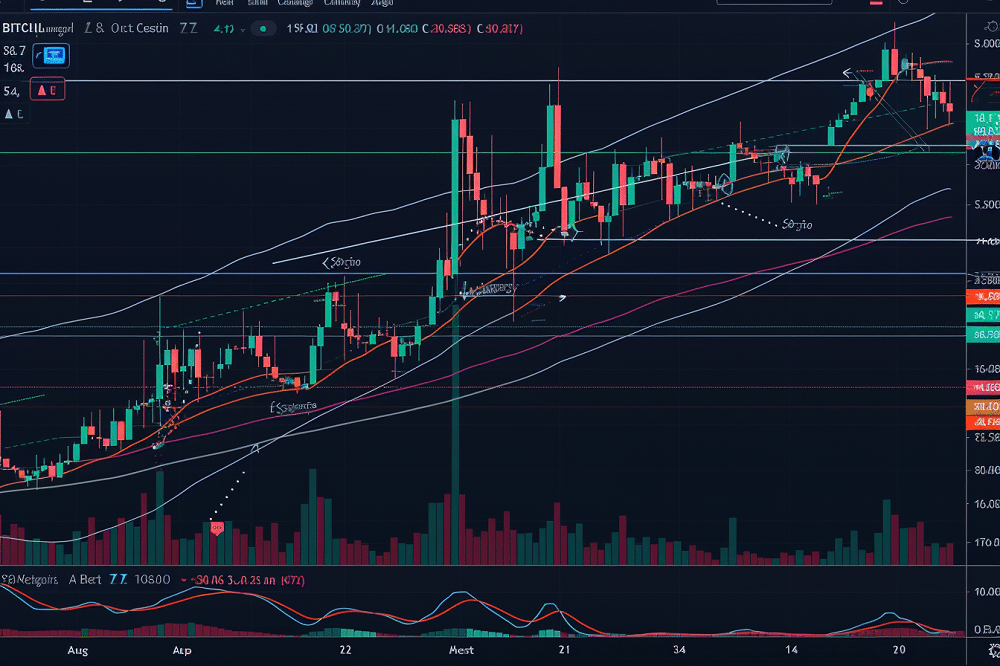

An Increase in the Number of Large Transactions Using Bitcoin Cash: A Warning Sign?

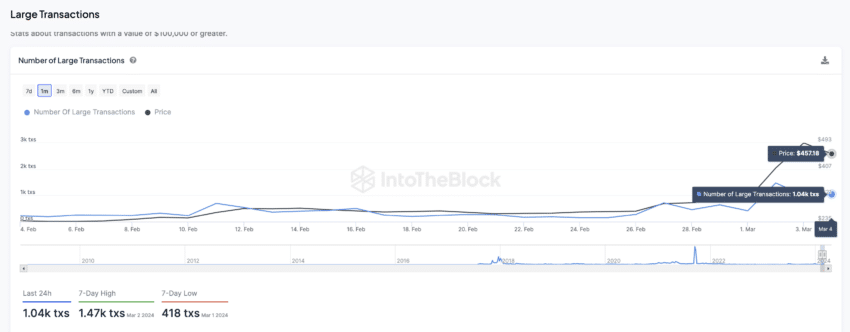

The latest information regarding Bitcoin Cash (BCH) has brought attention to a significant increase in substantial transactions, specifically those surpassing $100,000, which surged from 418 to 1,004 within just two days, from March 1 to March 3.

The upward trend persisted with a significant peak on March 2, as BCH recorded 1,470 substantial transactions, marking the highest number since late December 2023.

Typically, experienced investors see a rise in substantial deals as a positive indicator. It indicates an increasing sense of assurance among major traders and investors, potentially boosting market liquidity and improving order execution.

Total Count of Significant Transactions (BCH)

Nevertheless, the recent increase in significant BCH transactions has prompted a more detailed analysis. Although the usual optimistic perspective is prevalent, it’s essential to take into account the historical background that could suggest an imminent market downturn.

For example, the recent pair of surges in significant transactions resulted in declines. During the period from December 30 to January 5, a significant event occurred: BCH dropped in price by 13% after a surge in large transactions, going from $270 to $235.

This pattern indicates that significant transaction spikes can signal increased activity but may also come before periods of volatility or market corrections. Investors may interpret this as a warning sign, suggesting a more cautious strategy when entering the market.

Recent Times Have Seen a Rise in the Number of Negative Comments Regarding Bitcoin Cash

From February 29 to March 4, the general attitude towards BCH on different social media channels was chiefly unfavorable. On March 4, it reached its highest negative sentiment score of -3.59, which represents the most minimal sentiment level recorded since January 12.

What stands out is that this period of pessimism aligns with a notable price increase for Bitcoin Cash. Between February 29 and March 4, the value of Bitcoin Cash surged from $292 to $518, demonstrating a remarkable growth of 77.4%. Despite the prevailing negative trend emphasized by the Weighted Sentiment metric, this increase took place.

The Weighted Sentiment metric is crafted to carefully assess the present mood and overall sentiment within a specific cryptocurrency ecosystem. It evaluates the number of favorable remarks regarding Bitcoin Cash and the total number of unfavorable references it garners.

Although there has been a noticeable change towards a more optimistic outlook recently, this may not be enough to maintain or bolster the price of BCH. Given the notable increase in BCH’s value in recent days, this point becomes especially relevant. Surprisingly, the price hike happened even though the ecosystem mainly had been associated with negative feelings.

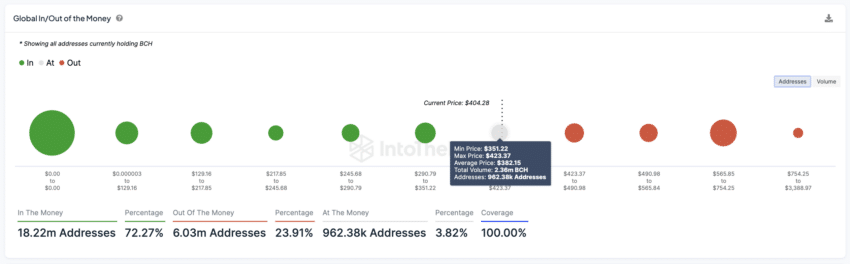

An Analysis of the Bitcoin Cash Price: Will the Support of $400 Be Sufficient?

The worldwide In/Out of the Money (GIOM) measure for Bitcoin Cash indicates that numerous addresses, precisely 962,380, are considered “At The Money,” indicating they bought BCH around the current price range.

This frequently suggests the presence of a possible resistance level; if the price begins to increase, these investors may consider selling to recover their initial investment, potentially leading to higher selling pressure and limiting any upward momentum.

Global In/Out of the Money for BCH

A range of $290 backs the price of BCH to $350. If existing holders fail to maintain Bitcoin Cash above $400, it could fall to around $350, resulting in a 13.5% decrease from its current value of $405.

Conversely, the resistance for Bitcoin Cash is currently set at $420, and there are wallets containing amounts ranging from $420 to $490. If investors maintain the support level and surpass the resistance, it could lead to a potential price increase for BCH.

Moreover, fresh, optimistic market data or broader positive sentiment could stimulate additional purchasing, leading to a rise in price. In the event that the price surpasses the $420 resistance level and stays above it, this could alter the overall sentiment and possibly disprove the negative outlook, leading to holders who are currently at a loss deciding to wait for a rebound, which could decrease the selling pressure.