As the time until Bitcoin’s fourth halving gets shorter, talk has already been set on fire as people think about whether similar bullish rises seen in the past might happen again.

After a careful look at all the data, it’s clear that the price movements of the product in question have been very similar both before and after the most recent pair of events.

Effect of Halving

The mysterious builder Satoshi Nakamoto cleverly used a phenomenon called “the halving” to start the network. This carefully planned event happens at exact times of 210,000 blocks, about once every four years. Its purpose, hidden by clever cryptography, is to carefully cut the rewards given to hardworking miners, essentially half their awards. This smart move is a substantial barrier that slows the spread of new BTC units.

Because of underlying economic forces, these events have made the object’s price move in a good direction. In general, the value of an item goes up when the rate of supply slows down while demand stays the same or goes up.

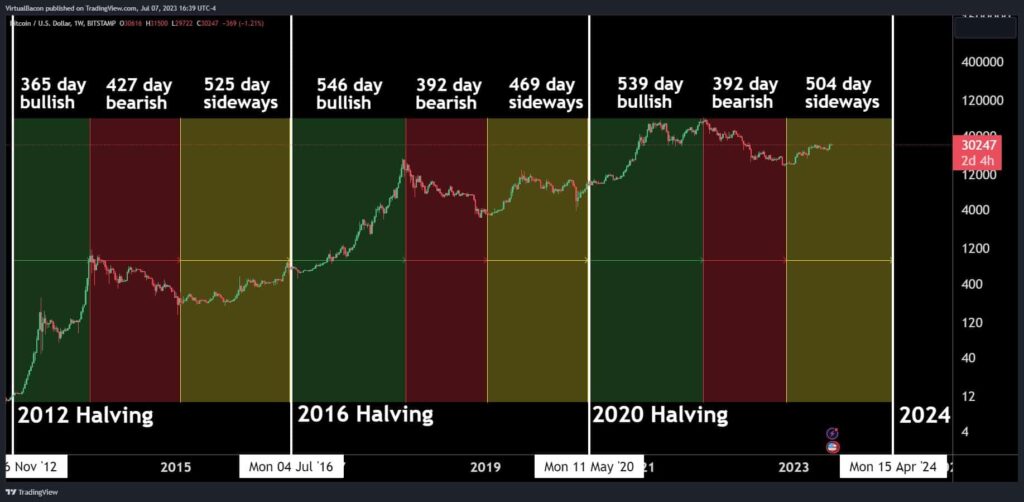

According to what has happened in the past, it is essential to remember that prices went up significantly after each of the three previous halvings. The previous event occurred in mid-May 2020. After that, Bitcoin started a clear rising cycle that lasted eighteen months and ended with an all-time high (ATH) price of $69,000 in November 2021. The situation was similar to the time after the 2016 split, when the all-time high (ATH) happened in December 2017 and reached a crazy high of almost $20,000.

As the above graph shows, the asset’s performance has followed an eerily similar path before and after the most recent pair of halvings. The trip of cryptocurrencies starts with an impressive 1.5–2 year period of bullish energy. Significant price corrections and a period of sideways price movement follow this. Based on the data analysis, Bitcoin (BTC) has reached its lowest point after a long downward trend lasting nearly 400 days. This critical event happened a year ago when the price of BTC dropped by a lot, falling below the $16,000 mark.

Will the Past Come Back?

All financial experts agree that you shouldn’t use how something did in the past as a guide for how it will do in the future. A previous study released by Coinbase said the same thing. It also noted that the effects of the upcoming halving still need to be discovered, mainly because macroeconomic factors and governmental policies are hard to predict.

But there were reports that the asset’s value had already been set before the half of 2020. According to these people, buyers shouldn’t expect fireworks because the asset’s value has already been priced.

Even so, it is still hard to guess how BTC will do in the future. Even the AI chatbot ChatGPT, which many people use, refrained from making such a statement not too long ago.