The SEC is still unsure whether SOL should be considered a security, so it appears that the SEC in the United States is unwilling to provide permission for Solana exchange-traded funds.

A lengthy period of time passed before exchange-traded funds linked to the spot price of Bitcoin were ultimately able to enter the markets in the United States. In the same way that the process was chaotic, issuers sought permission for an Ether (ETH) exchange-traded fund (ETF).

The Securities and Exchange Commission has already demonstrated opposition, so it would appear that creating a Solana (SOL) exchange-traded fund (ETF) will be rather difficult.

As investors attempt to capitalize on the price changes of top digital assets without actually owning them, a significant amount of money has been pouring into cryptocurrency exchange-traded funds (ETFs) in recent months. This is because ETFs allow users to invest in many cryptocurrencies at once.

Issuers appear keen to broaden their possibilities by producing funds based on currencies with a lower market capitalization. This is because they have been encouraged by the success of such products.

On the other hand, there is a minor problem: the Securities and Exchange Commission (SEC) has not yet reached a judgment about the classification of SOL as a security, and this is a barrier to the progress of applications.

Obtaining approval requires a multitude of documents and negotiations between the parties involved. What has occurred in this situation?

The most recent controversy revolves around Cboe Global Markets, which filed 19b-4 documents on behalf of two companies seeking to introduce Solana ETFs in the United States.

This request essentially seeks approval from the SEC to list exchange-traded funds introduced by VanEck and 21Shares, both of whom are already established participants in the cryptocurrency ETF market.

This is a noteworthy development as it initiates a countdown, requiring regulators to take action within a specified timeframe. (However, in reality, the SEC has consistently postponed making decisions, pushing them off to a future date.)

However, the exciting part is that the timer starts ticking only when the 19-4b filings are officially included in the Federal Register. Unfortunately, Cboe’s request didn’t even reach this stage, according to a recent report.

Solana ETFs may still be approved in the future, but Cboe might have to reconsider and improve its proposal.

What About the Individuals Responsible for the Matter?

Now, let’s shift our focus to the second piece of the puzzle that we have discovered. Cboe is free to file an unlimited number of 19-4bs, but the only way for a Solana exchange-traded fund (ETF) to be approved is if the issuer submits an S-1 form. Before the issuer may make its debut on a national exchange, this form provides an outline of the issuer’s comprehensive intentions.

VanEck, the most well-known investment management company in the United States, comes into play at this point in the scenario. Included in the current roster is HODL, a spot Bitcoin exchange-traded fund (ETF) that manages approximately $648 million in net assets and ranks seventh in a very competitive market. With a slightly lower total of $58 million, the alternative to the Ether exchange-traded fund (ETF) known as ETHV comes in at number five.

The commitment of VanEck has remained strong despite the fact that the Securities and Exchange Commission (SEC) is unwilling to work with Cboe. The following comment was given by Matthew Sigel, who is the head of digital assets research at the fund, during an interview that took place this week:

Keep in mind that Exchanges such as Nasdaq and CBOE submit rule modifications (19b-4) to include new ETFs on their listings. VanEck and similar entities are accountable for the creation and distribution of the prospectus (S-1). Our position is still in play.

The status of the 21Shares Solana ETF is uncertain in comparison — indicating that this issuer may be stepping aside while the regulatory situation is resolved.

What Sets SOL Apart From the Rest?

You may be curious about the reasons behind the SEC’s decision to reluctantly approve BTC and ETH ETFs for the market while excluding SOL.

After extensive deliberation, which involved discussions about “market manipulation” and a legal dispute with Grayscale, the SEC finally relented and reached the conclusion that Bitcoin and Ether could be classified as commodities rather than securities. The involvement of major players like BlackRock and Fidelity as issuers of ETF products tied to the leading cryptocurrencies likely had an impact as well.

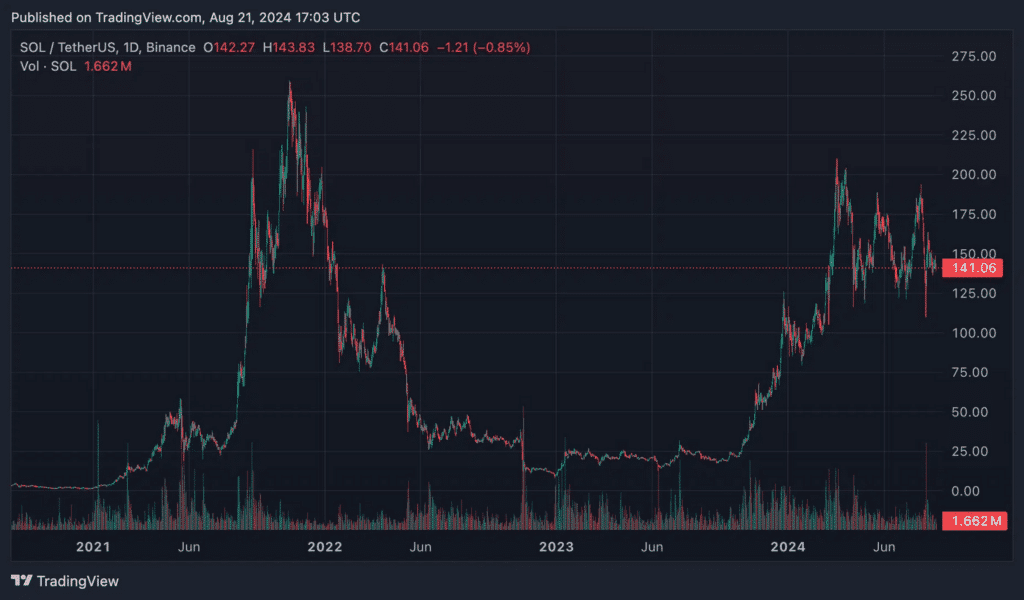

Returning to Solana, it regrettably had strong connections with Sam Bankman-Fried and a series of notable disruptions associated with its reputation. The SEC has been actively pursuing legal action against various companies, including Coinbase, alleging that they have operated as unregistered securities brokers by enabling their customers to engage in SOL trading. Adopting a more lenient approach towards ETF applications could weaken its position in ongoing legal disputes in other areas.

However, apart from the legal and regulatory challenges, there is another inconvenient reality that requires attention: if a Solana ETF is introduced, there may not be a significant level of demand.

The disparity in assets under management between Bitcoin exchange-traded funds and Ether ETFs can be attributed to differences in brand recognition. Currently, Bitcoin ETFs have amassed an impressive $48 billion in assets, while Ether ETFs are trailing behind with $7.3 billion.

BlackRock and Fidelity, both of whom have not indicated any plans to introduce a Solana offering, have significantly influenced this enthusiastic movement.

Given the absence of both players, it is likely that the SEC will have little motivation to alter its position.