According to Glassnode, a company specializing in on-chain analytics, Bitcoin typically reaches a potential peak when long-term holders exhibit this behavior.

Holders of Bitcoin for an Extended Period Have Been Increasing Distribution

A report that Glassnode recently published provides an analysis of the influence that long-term holders of Bitcoin have on the supply dynamics of various cryptocurrencies. Individuals who have kept their Bitcoins for more than 155 days are referred to as “long-term holders” (LTHs), and they are considered to be investors in Bitcoin.

Individuals who hold Bitcoin for an extended period are referred to as Long-Term Holders (LTHs), and they constitute a sizeable portion of the Bitcoin user base. The remaining cohort is comprised of the other group, which is more commonly known as the “short-term holders” (STHs).

For the entirety of market history, the LTHs have firmly established themselves as the unyielding forces that dominate the market. Regardless of the conditions that are currently prevalent in the market as a whole, they need to sell their coins in a timely manner. On the other hand, the STHs frequently react to situations that involve fear, uncertainty, and doubt (FUD), as well as the fear of missing out (FOMO).

The STHs are, therefore, frequently seen engaging in the act of selling, which is a common occurrence. On the other hand, it is essential to take into account the long-term holders (LTHs) who continue to keep their assets, as any potential sale from these long-term holders could affect the market.

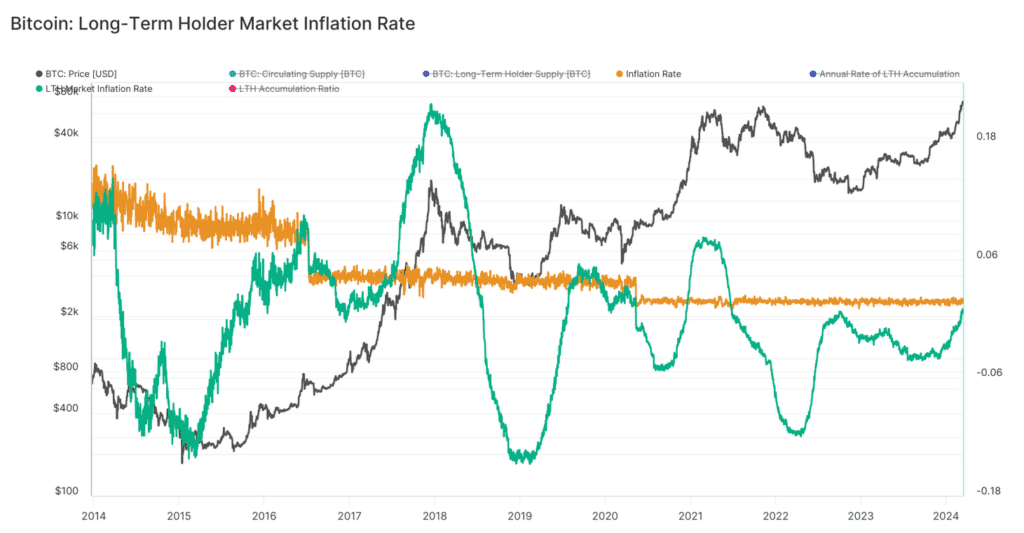

There are numerous methods for monitoring the actions of the LTHs, but for this conversation, Glassnode has employed the metric known as the “LTH Market Inflation Rate.”

According to the report:

This displays the yearly rate at which Bitcoin is being accumulated or distributed by long-term holders in comparison to the daily issuance by miners. This metric assists in identifying phases of overall accumulation, during which long-term holders actively withdraw Bitcoin from the market, and phases of the overall distribution, during which long-term holders contribute to the selling pressure in the market.

Presented below is a comprehensive chart illustrating the fluctuation in the BTC LTH Market Inflation Rate throughout recent years:

The data that the analytics company has collected on the asset’s inflation rate is also included in the chart. This rate is the quantity of new coins that are added to the supply of coins that are currently in circulation on a regular basis as miners solve blocks and receive rewards.

As soon as the rate of inflation on the LTH Market reaches zero percent, these HODLers will begin to accumulate quantities that are precisely equivalent to the issuance created by the miners.

According to this, when the indicator is below the 0% mark, it indicates that long-term holders (LTHs) are removing coins from circulation. This is the case when the indicator is below the 0% mark.

The indicator, on the other hand, indicates that LTHs are either distributing their coins or not purchasing enough to offset the supply produced by miners when it is above the 0% mark. This suggests that the indicator is offsetting the supply.

The graph shows that in the past, the price of cryptocurrency has typically reached a point of equilibrium and possibly even a peak when the distribution among long-term holders has reached its highest point.

Over the past few months, the rate of inflation in the LTH Market has been on the rise, although it has not yet reached any particularly noteworthy levels. Glassnode offers the following analysis with regard to the potential impact that it could have on the market:

Based on the current rate of inflation in the LTH market, we are in the beginning stages of a distribution cycle, with approximately thirty percent of the cycle having already been completed. This indicates that there will be significant movement in the near future as we work toward achieving a balance between supply and demand, which may result in price peaks reaching their highest point.

Bitcoin Price

Bitcoin has pulled back a significant portion of its recent rebound, with its price now dropping to $63,800.