The excitement surrounding Bitcoin ETFs in the cryptocurrency market has been tremendous. However, the enthusiasm surrounding Ethereum, the cryptocurrency that holds the second-highest market capitalization, appears to be subdued.

Industry experts suggest that a blend of market forces, investor comprehension, and the distinct characteristics of Ethereum could account for its success.

Interest From Institutions in Ethereum Exchange-Traded Funds

Raoul Pal, the CEO of Real Vision, pointed out a significant distinction between Bitcoin and Ethereum. “Ethereum provides a more diverse technological opportunity and returns that Bitcoin lacks,” he expressed. This differentiation is crucial for institutional investors, who are seeking not only price appreciation but also additional advantages.

Pal contended that in the absence of staking yields, institutions might opt to possess Ethereum directly. The reason for this preference is that by holding the asset, individuals have the opportunity to risk it and generate yields, which ETFs do not commonly offer.

As an example, at Coinbase, individuals who stake Ethereum currently earn an annual yield of 3.46% when they retain ETH for a year. Now, the staking ratio for Ethereum stands at 23.32%, indicating the percentage of eligible tokens that are actively participating in staking.

Institutional investors may find direct ownership more appealing, making the concept of Ethereum ETFs less enticing. Pal expressed worries about the potential dynamics, where asset managers might take advantage of the staking yields without sharing these advantages with ETF holders. This situation may result in a decrease in institutional enthusiasm for Ethereum ETFs.

Many institutions have a preference for owning ETH directly as it allows them to stake it and earn yield. If you fail to provide them with returns, an asset manager who introduces the ETF will become wealthy. According to Pal, BlackRock is set to benefit significantly from the ETH staking yield without sharing it with the ETF holders. This could result in BlackRock accumulating significant profits.

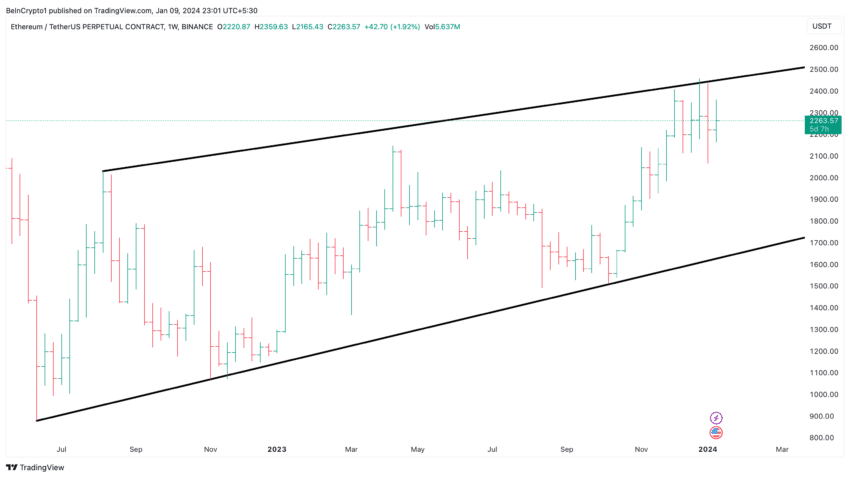

Price Prediction for Ethereum: A Correction Is Coming

Contrarily, Peter Brandt, an experienced trader, shared a pessimistic outlook on Ethereum. His strategy as a swing trader demonstrates a focus on short-term speculation and a preference for shorting rather than making long-term investments.

Brandt suggests that ETH is currently trading within a wedge pattern, indicating a potential correction towards the $1,000 level or possibly even as low as $650.

“I still have a preference for selling ETH.” I prefer to engage in swing trading with ETH rather than holding onto it for the long term. The chart lacks a solid foundation. Should I decide to enter a position below $2,100 and my analysis proves to be incorrect, it wouldn’t be a significant concern for me.”

– Peter Brandt

Bitcoin and Ethereum, the top cryptocurrencies, attract investors with distinct appeals. Bitcoin is commonly regarded as a “digital gold,” serving as a reliable store of value, while Ethereum is recognized as a versatile platform for creating decentralized applications and smart contracts.

The contrasting nature of this distinction shapes the potential perception and utilization of cryptocurrency ETFs among various investor groups, ultimately impacting market prices.