The price of Dogecoin has garnered significant interest lately as it teeters on the verge of a potential bullish breakout. In the midst of a highly unpredictable cryptocurrency market, DOGE, a token that originated as a meme, is currently displaying indications of a notable upward trend. The recent spike in the price of Dogecoin has generated a lot of enthusiasm among both investors and cryptocurrency enthusiasts.

During the previous week, DOGE has been fluctuating below a trend line that extends over a long period, staying in the range of $0.0800 to $0.0900. Regardless of these fluctuations, analysts continue to maintain an optimistic outlook.

Significant Levels of Resistance and Support for Dogecoin Price

The price of Dogecoin has been closely tracking its expected market trajectory. Presently priced at $0.08372, it has experienced a significant 24-hour rise of more than 2%, indicating a favorable change in market momentum. The trading volume for Dogecoin is a remarkable $519 million, showing a surge in investor enthusiasm. With a market cap of $11.94 billion, Dogecoin is among the top 10 cryptocurrencies in terms of value.

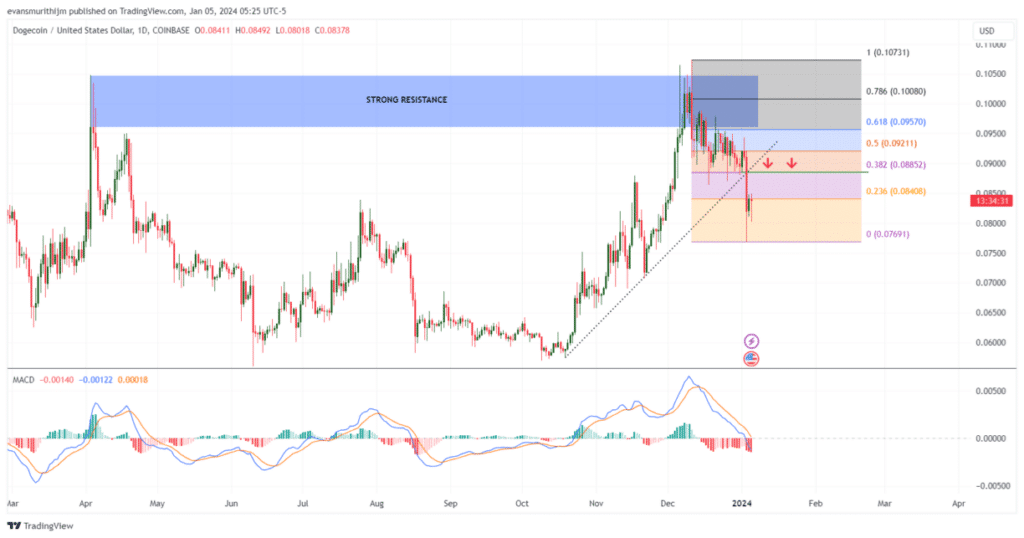

Nevertheless, during recent trading sessions, Dogecoin has faced some obstacles. In spite of attempts to exceed the $0.0920 level, it has faced difficulties due to the strong resistance at $0.095. As a result, it has experienced a slight decrease, following the trend of other cryptocurrencies like Bitcoin and Ethereum. The cryptocurrency went through a decline below the support levels of $0.0900 and $0.0865 and even explored the $0.0760 zone at one stage.

Based on the current situation, if the price of Dogecoin manages to stay above the resistance level of $0.090, it could rebound to the $0.092 level and then potentially reach the critical mark of $0.095. In addition to this, further increases could drive the price towards the $0.105 mark. The positive perspective highlights the coin’s capacity to surpass crucial resistance levels and sustain a favorable momentum in the Dogecoin market.

On the other hand, if there is an inability to surpass the $0.0875 level, it may lead to a new downward movement. There is a support level close to $0.080 and a more substantial support level at $0.0760. If Dogecoin were to drop below this point, it could move towards the $0.0710 mark.

Forecast and Technical Signals for Dogecoin Price

Remarkably, market expectations continue to soar. In a recent post on X (formerly Twitter), Crypto analyst JD expressed admiration for the Dogecoin price chart, describing it as visually appealing. According to his analysis, there is a potential increase in the value of DOGE expected in 2024. If his forecasts prove accurate, Dogecoin has the potential to experience a remarkable surge, possibly reaching unparalleled levels of approximately $9.

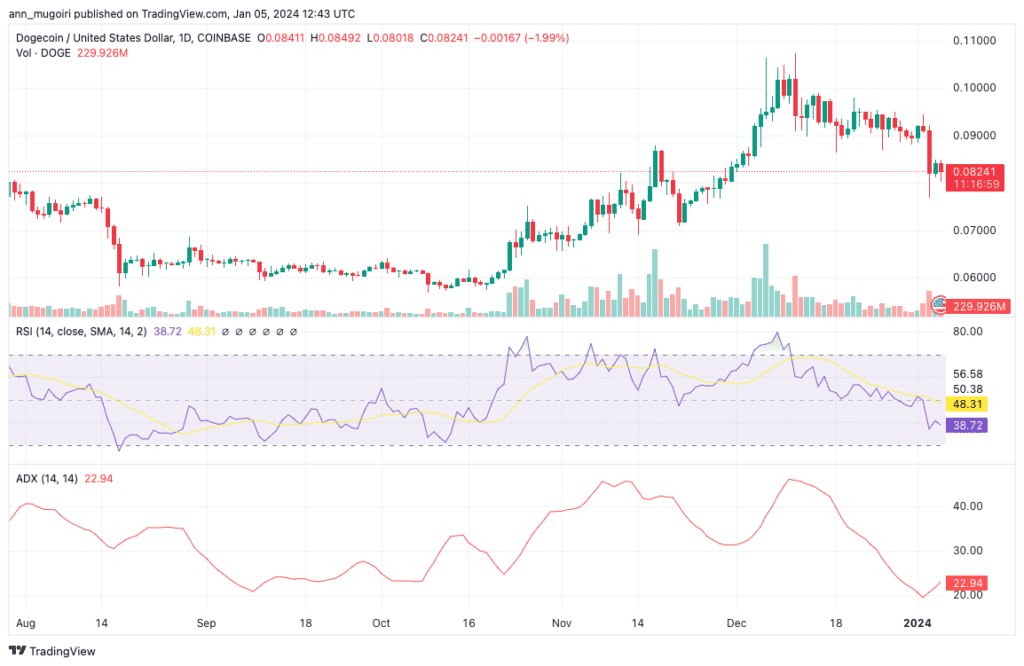

In addition, there are various technical indicators, like the Moving Average Convergence Divergence (MACD), that suggest a positive trend for DOGE/USD. The signal line is currently above the MACD line, indicating an increase in buying activity. The ADX sits at 22, suggesting the possibility of a significant increase. Nevertheless, the Relative Strength Index (RSI) for DOGE/USD, which is currently situated below the 50 level, suggests a neutral position in the market.

The price of Dogecoin is currently charting a course filled with various possibilities, with the general market sentiment leaning towards a positive outlook. Investors and enthusiasts are closely watching this dynamic cryptocurrency, paying attention to crucial resistance and support levels and eagerly anticipating its next move.